Company Paid Life Insurance Taxable

The premium cost for the first 50000 of life insurance coverage provided under an employer provided group term life insurance plan does not have to be reported as income and is not taxed to you. It was always my understanding that if an employer is the beneficiary of a life insurance policy then no p11d benefit will arise.

How To Cancel Your Life Insurance Policy Policygenius

How To Cancel Your Life Insurance Policy Policygenius

Learn about the tax implications of life insurance premiums including when they might be taxable and whether they are tax deductible.

Company paid life insurance taxable. Besides income tax withholding there might also. Employer paid life insurance. Some benefits for sickness and accidents may be.

Furthermore the company. Likewise f the employee is the benificiary then its a taxable benefit which should be reported on form p11d. The tax deductions that companies received were often greater than the actual cost of the premiums paid.

This is not going to increase your taxes so dont panic. If a company provides benefits to its employees the business might also be providing taxable income that employees must report to the internal. But premiums your employer pays for any face amount of insurance over 50000 are treated by the internal revenue service as income paid to you and you will have to pay income tax on this amount.

The cost of employer provided group term life insurance on the life of an employees spouse or dependent paid by the employer is not taxable to the employee if the face amount of the coverage does not exceed 2000. In most cases the cost of the insurance paid by the company is deemed to be an allowable business expense. This coverage is excluded as a de minimis fringe benefit.

Life insurance for company directors. Company owned life insurance. Are company paid insurance premiums taxable income.

Whether any company provided life insurance you receive is taxable depends on the type the amount and the beneficiaries of the insurance proceeds. Under the federal affordable care act employers must start reporting the cost of your coverage on your form w 2. Be taxable according to its.

Premiums your employer pays for health accident or disability insurance arent taxable income. Employer paid life insurance may have a tax cost. If this is the case then the cost of the insurance will become part of the employees overall remuneration package.

Employer paid life insurance premiums covering the first 50000 in insurance are not taxable to you.

Business Solutions Planning Stratigos Consulting Group

Business Solutions Planning Stratigos Consulting Group

How And Why To Adjust Your Irs Tax Withholding Bankrate Com

How And Why To Adjust Your Irs Tax Withholding Bankrate Com

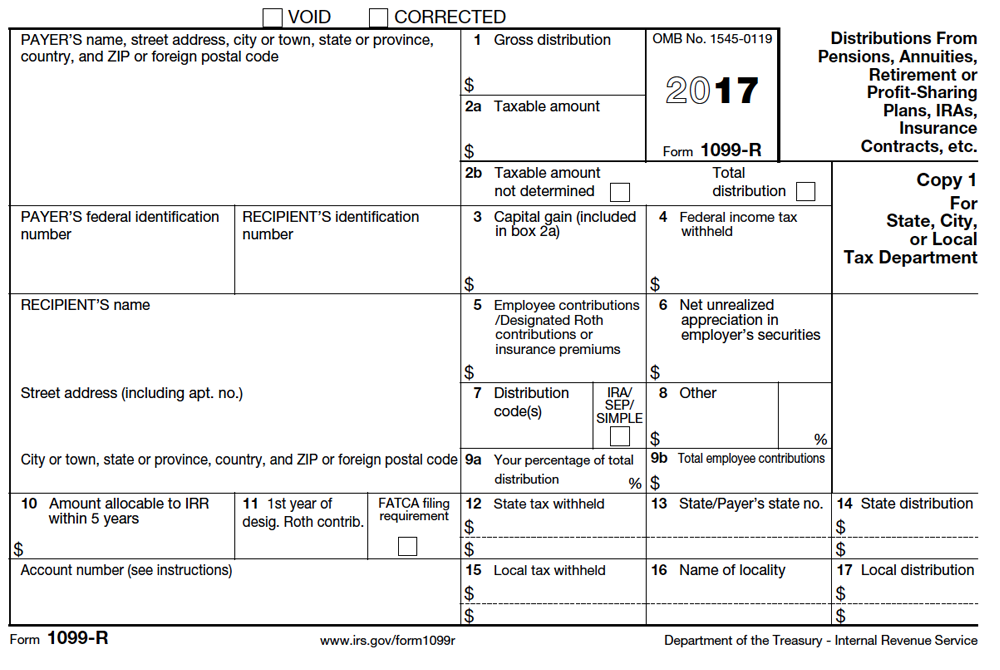

Tax Information Regarding Forms 1099 R And 1099 Int That We Send

Tax Information Regarding Forms 1099 R And 1099 Int That We Send

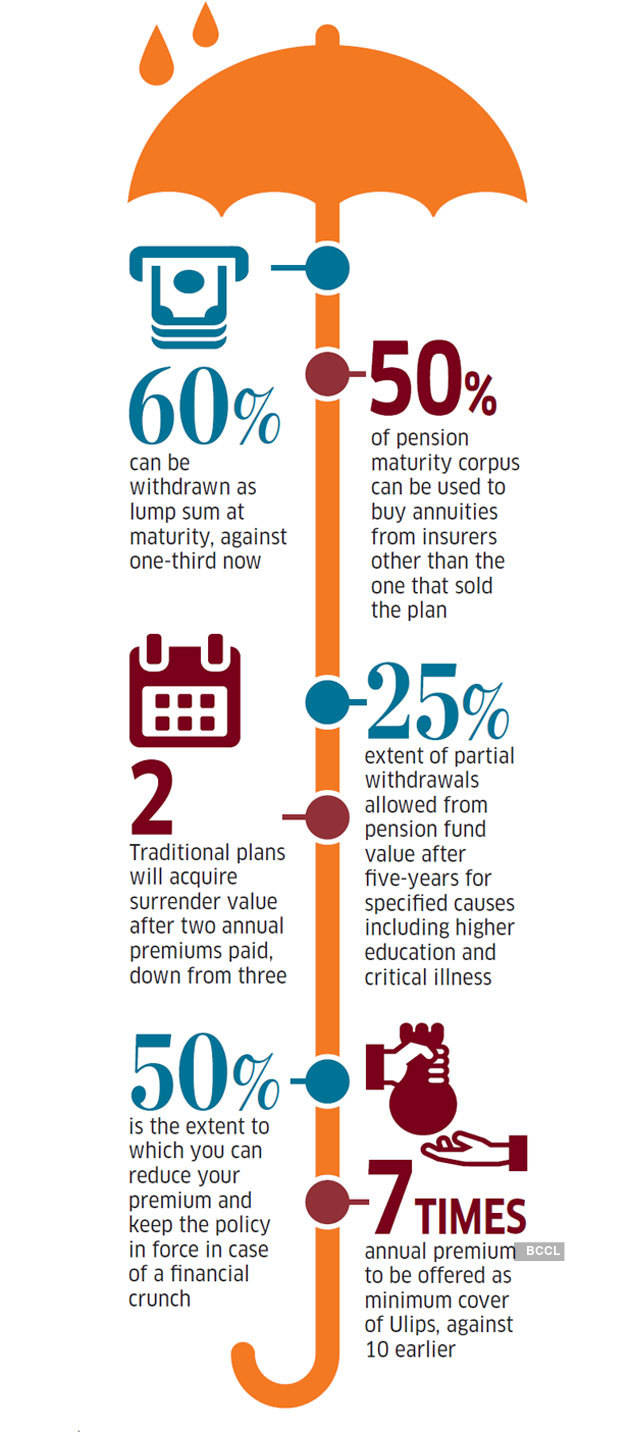

Term Life Insurance Buying Life Insurance Policy Here S Why You

Term Life Insurance Buying Life Insurance Policy Here S Why You

Understanding Whole Life Insurance Dividend Options

Understanding Whole Life Insurance Dividend Options

Life Insurance Policy Loans Tax Rules And Risks

Life Insurance Policy Loans Tax Rules And Risks

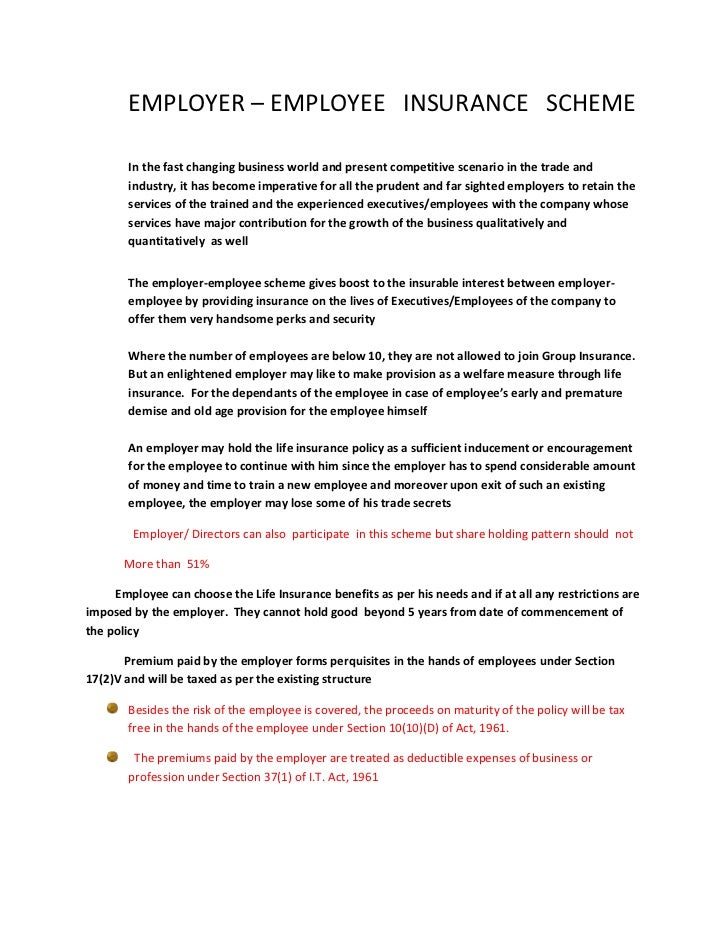

Employer Employee Insurance Scheme

Employer Employee Insurance Scheme

Taxation In The United States Wikipedia

Taxation In The United States Wikipedia

Business Insurance Understanding The Tax Implications Pdf Free

Business Insurance Understanding The Tax Implications Pdf Free

Is Life Insurance Taxable Allstate

Is Life Insurance Taxable Allstate

Payroll Taxes And Employer Responsibilities

Payroll Taxes And Employer Responsibilities

3 Advantages Of Corporate Owned Life Insurance Nick Godfrey

3 Advantages Of Corporate Owned Life Insurance Nick Godfrey

Group Term Life Insurance Chapter 41 Employee Benefit Retirement

Group Term Life Insurance Chapter 41 Employee Benefit Retirement

I Received Rs 1 3 Lakh From Lic Policy After 1 Tds Cut Will I

I Received Rs 1 3 Lakh From Lic Policy After 1 Tds Cut Will I

:brightness(10):contrast(5):no_upscale()/GettyImages-658436106-591e3b083df78cf5fad9a2a2.jpg) Employer Guide What Employee Compensation Is Taxable

Employer Guide What Employee Compensation Is Taxable

Download Instructions For Irs Form 1099 Ls Reportable Life

Download Instructions For Irs Form 1099 Ls Reportable Life

How Is A Life Insurance Death Benefit Paid Out Northwestern Mutual

How Is A Life Insurance Death Benefit Paid Out Northwestern Mutual

/GettyImages-658436106-591e3b083df78cf5fad9a2a2.jpg) Employer Guide What Employee Compensation Is Taxable

Employer Guide What Employee Compensation Is Taxable

Blog The Tunstall Organization Inc The Tunstall Organization

Blog The Tunstall Organization Inc The Tunstall Organization

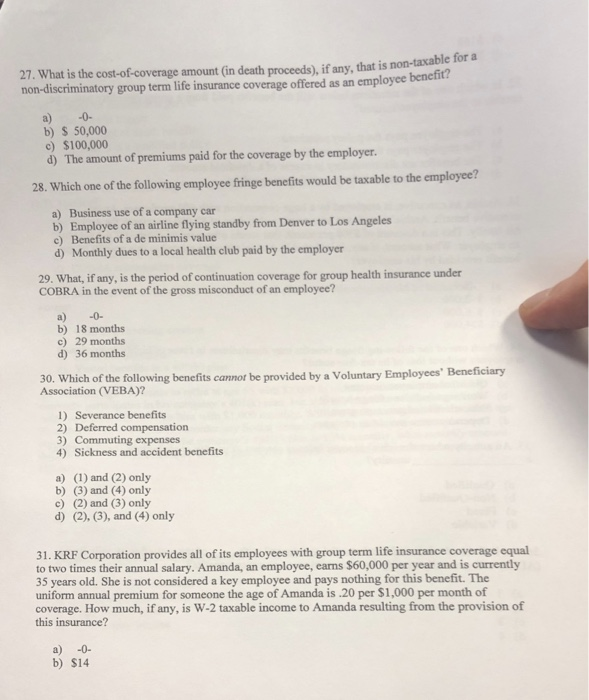

Solved 27 What Is The Cost Of Coverage Amount Gin Death

Solved 27 What Is The Cost Of Coverage Amount Gin Death

Golocalworcester Smart Benefits Imputed Income For Group Term

Golocalworcester Smart Benefits Imputed Income For Group Term

:max_bytes(150000):strip_icc()/employer-guide-employee-moving-expenses-4141194-color-2-22282f9c075b4ed09b81564deb33455e.jpg)

Post a Comment for "Company Paid Life Insurance Taxable"