Do Life Insurance Policies Get Taxed

When in doubt as to whether or not you need to take taxes into account on your policy your agent will be able to help. Life insurance isnt a fun topic to think about but it can protect your loved ones in the event you were to pass away.

/GettyImages-658436106-591e3b083df78cf5fad9a2a2.jpg) Employer Guide What Employee Compensation Is Taxable

Employer Guide What Employee Compensation Is Taxable

Life insurance is designed to provide a safety net for your loved ones when you die a cushion upon which they can continue to lead normal.

Do life insurance policies get taxed. Permanent life insurance policies payouts may be taxed but only in situations where you take advantage of their ability to accumulate value and serve as short term loans from your insurance company. It is known in tax speak as a qualifying policy. Most of the time proceeds arent taxable.

Of course in most life contracts the beneficiaries do not get the cash values upon death of the insured as they go back to the company upon death. But there are certain. There are various types of life insurance but term insurance is the most common and the most straightforward.

Sometimes life insurance payouts are paid to the estate of the deceased rather than directly to a beneficiary. Types of life insurance policy. Generally speaking when the beneficiary of a life insurance policy receives the death benefit this money is not counted as taxable income and the beneficiary does not have to pay taxes on it.

Life insurance distributions following death life insurance distributions following the death of someone else are not taxed. As the cash value grows you may ultimately have more money in cash value than you paid in premiums. This may occur if the policys beneficiary dies before they can receive the payout and there are no other beneficiaries.

Heres a primer on what to do if your life insurance beneficiary dies before you. Term insurance pays out a cash sum if you die within the term of the plan and is not normally subject to income or capital gains tax. Life insurance can help with end of life expenses such as your funeral and it can help relieve certain tax liabilities for your survivors.

However before purchasing life insurance you should understand how the canada revenue agency taxes its distributions. Unlike term life insurance policies some life insurance policies eg permanent life have a cash value component. Find out how to get tax free life insurance and compare quotes.

This makes whole life insurance a very bad investment and guarantees the insured to be underinsured. Our guide to life insurance tax outlines when tax is applicable to life insurance payouts. Do i have to pay income tax on life insurance payouts.

Generally you are allowed to defer income taxes on those gains as long as you dont sell withdraw from or surrender the policy.

Is Life Insurance Taxable Daveramsey Com

Is Life Insurance Taxable Daveramsey Com

Indexed Universal Life Iul Insurance Policies All You Need To

Indexed Universal Life Iul Insurance Policies All You Need To

Taxation In The Republic Of Ireland Wikipedia

Taxation In The Republic Of Ireland Wikipedia

Are Life Insurance Payouts Taxable Life Ant

Are Life Insurance Payouts Taxable Life Ant

Solved Problem 3 37 Lo 3 3 Nancy Who Is 59 Years Old

Solved Problem 3 37 Lo 3 3 Nancy Who Is 59 Years Old

Ohio Life Final Exam Advantage Education Group Take Pages

Ohio Life Final Exam Advantage Education Group Take Pages

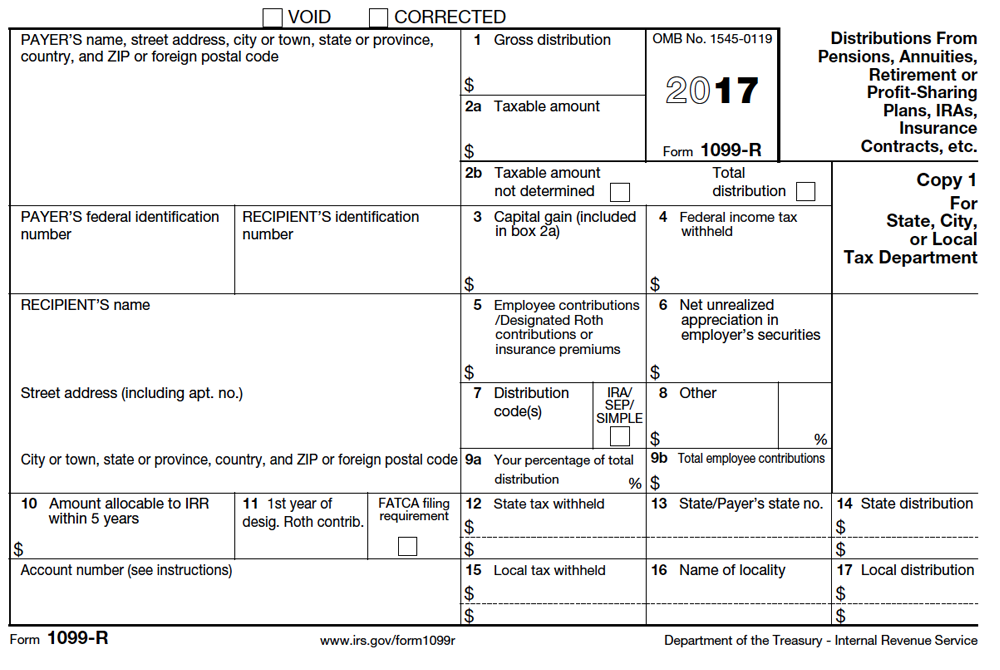

Tax Information Regarding Forms 1099 R And 1099 Int That We Send

Tax Information Regarding Forms 1099 R And 1099 Int That We Send

How Much Does Life Insurance Cost

How Much Does Life Insurance Cost

When To Cash In A Life Insurance Policy The Dough Roller

When To Cash In A Life Insurance Policy The Dough Roller

Journal Investigating The Role Of Whole Life Insurance In A

Journal Investigating The Role Of Whole Life Insurance In A

Is Life Insurance Taxable True Blue Life Insurance

Is Life Insurance Taxable True Blue Life Insurance

Preparing For 2016 Changes To The Taxation Of Life Insurance

Preparing For 2016 Changes To The Taxation Of Life Insurance

Ownership Structures For Life Insurance Policy Funded Buy Sell

Ownership Structures For Life Insurance Policy Funded Buy Sell

Budget 2019 Tweaks Taxes On Insurance Maturity Proceeds

Budget 2019 Tweaks Taxes On Insurance Maturity Proceeds

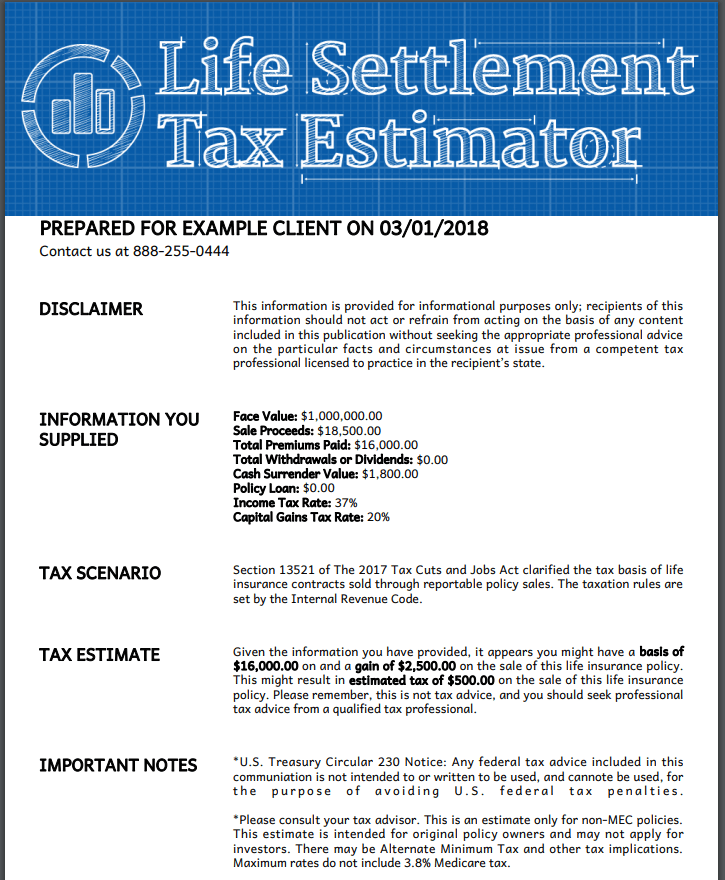

How Is The Sale Of A Life Insurance Policy Taxed Life

How Is The Sale Of A Life Insurance Policy Taxed Life

Payroll Taxes And Employer Responsibilities

Payroll Taxes And Employer Responsibilities

Tax Treatment Taxability Of Various Financial Investments

Tax Treatment Taxability Of Various Financial Investments

Key Facts Income Definitions For Marketplace And Medicaid

Key Facts Income Definitions For Marketplace And Medicaid

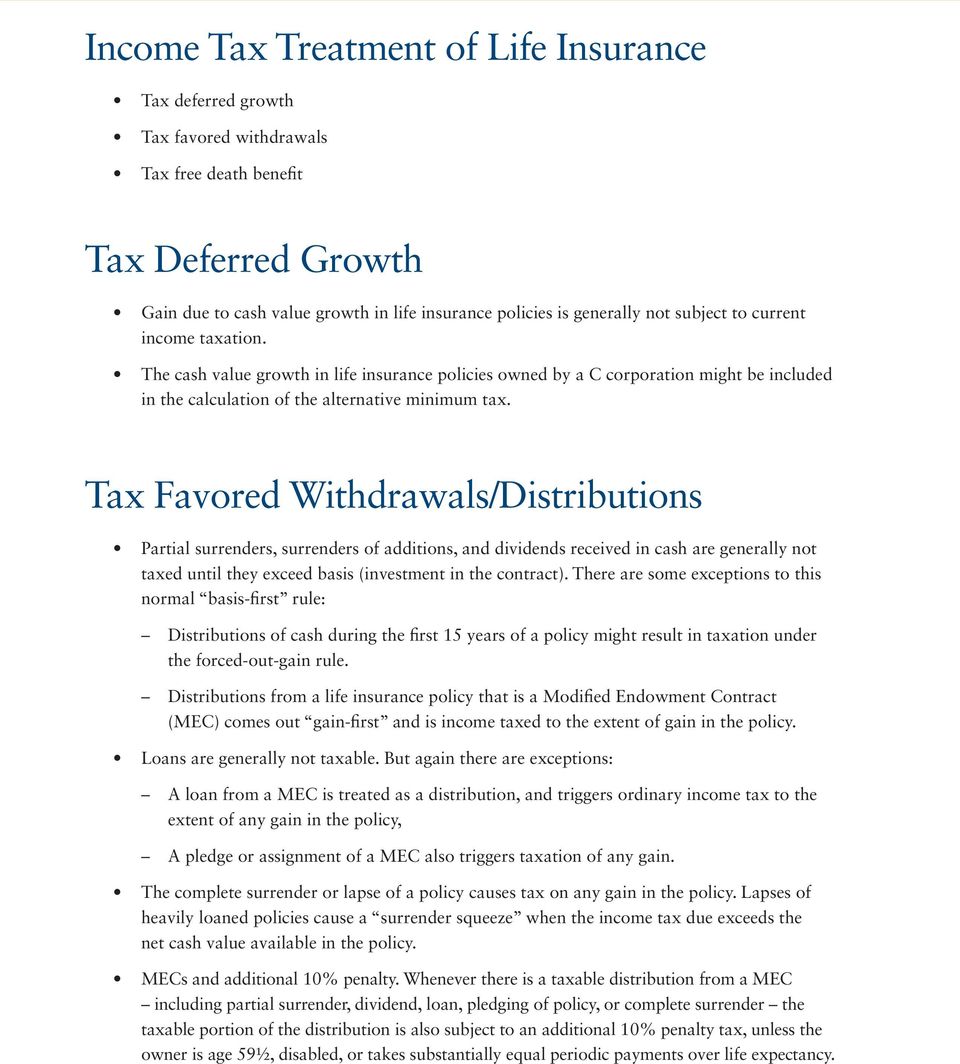

Life Insurance Income Taxation In Brief Pdf Free Download

Life Insurance Income Taxation In Brief Pdf Free Download

Low Cost Life Insurance How To Define It

Low Cost Life Insurance How To Define It

Life Insurance Income Taxation In Brief Pdf Free Download

Life Insurance Income Taxation In Brief Pdf Free Download

Taxable Amount On A Surrendered Life Insurance Policy Budgeting

Taxable Amount On A Surrendered Life Insurance Policy Budgeting

Post a Comment for "Do Life Insurance Policies Get Taxed"