Do You Pay Tax On Life Insurance Payout

When you write a life insurance policy in trust because the payout does not go to your legal estate its value will not count towards the inheritance tax threshold and. If you have taken out life insurance to provide a lump sum or regular income to your loved ones when you die there is usually no income or capital gains tax to pay on the proceeds of the policy.

Is Life Insurance Taxable True Blue Life Insurance

Is Life Insurance Taxable True Blue Life Insurance

So do you pay taxes on a life insurance payout.

Do you pay tax on life insurance payout. However if the total value of your estate is more than 325000 inheritance tax iht will be deducted from your insurance pay out at a rate 40. Life insurance protects your family against the devastating financial impact of death or disability with a tax free payout when they need it most. Life insurance is designed to provide a safety net for your loved ones when you die a cushion upon which they can continue to lead normal.

Do i have to pay income tax on life insurance payouts. Life insurance can be paid as annual payouts instead of a lump sum. A death benefit is a payout to the beneficiary of a life insurance.

If you believe your family is likely to owe inheritance tax on your estate after you die then it is important when taking out life insurance to calculate how much that tax bill might be. Lets examine a few exceptions to the general rule that life insurance proceeds are tax free. While you should consult with a tax professional to verify the tax status of any life insurance payout you receive we can give you some general rules and guidelines to consider.

If you received a life insurance payout last year you probably made more money in 2018 than you were. It is possible that some income tax may be due when the life insurance. Exception 1 taxing interest gained on life insurance pay outs.

Do beneficiaries pay taxes on life insurance. They say that two things in life that are certain. Life insurance has grown in complexity over the years and as a result life insurance taxation issues have become equally complex.

The right life insurance helps to protect your family from the consequences of both. Life insurance policies name a designated beneficiary or beneficiaries to receive a payout or death benefit in the case of the policyholders deaththe beneficiary will then file a claim with the life insurance company to receive their payout when the insured dies heres how that works.

Term Life Insurance Definition

Term Life Insurance Definition

New Irs Code 101 J Changes Requires Life Insurance Notice And

New Irs Code 101 J Changes Requires Life Insurance Notice And

Life Insurance Tax Can You Be Taxed On Life Insurance

Life Insurance Tax Can You Be Taxed On Life Insurance

Tds Life Insurance Budget 2019 Proposes 5 Tds For Taxable Life

Tds Life Insurance Budget 2019 Proposes 5 Tds For Taxable Life

/hispanic-saleswoman-talking-to-clients-in-living-room-580504711-5995f8d722fa3a001149763c.jpg) Life Insurance Death Benefits Estate Tax

Life Insurance Death Benefits Estate Tax

Avoid Surrendering Life Insurance Policy 1

Avoid Surrendering Life Insurance Policy 1

Are Life Insurance Payouts Taxable A Comprehensive Answer

Are Life Insurance Payouts Taxable A Comprehensive Answer

Are Life Insurance Proceeds Taxable Sfg Symmetry Financial Group

Are Life Insurance Proceeds Taxable Sfg Symmetry Financial Group

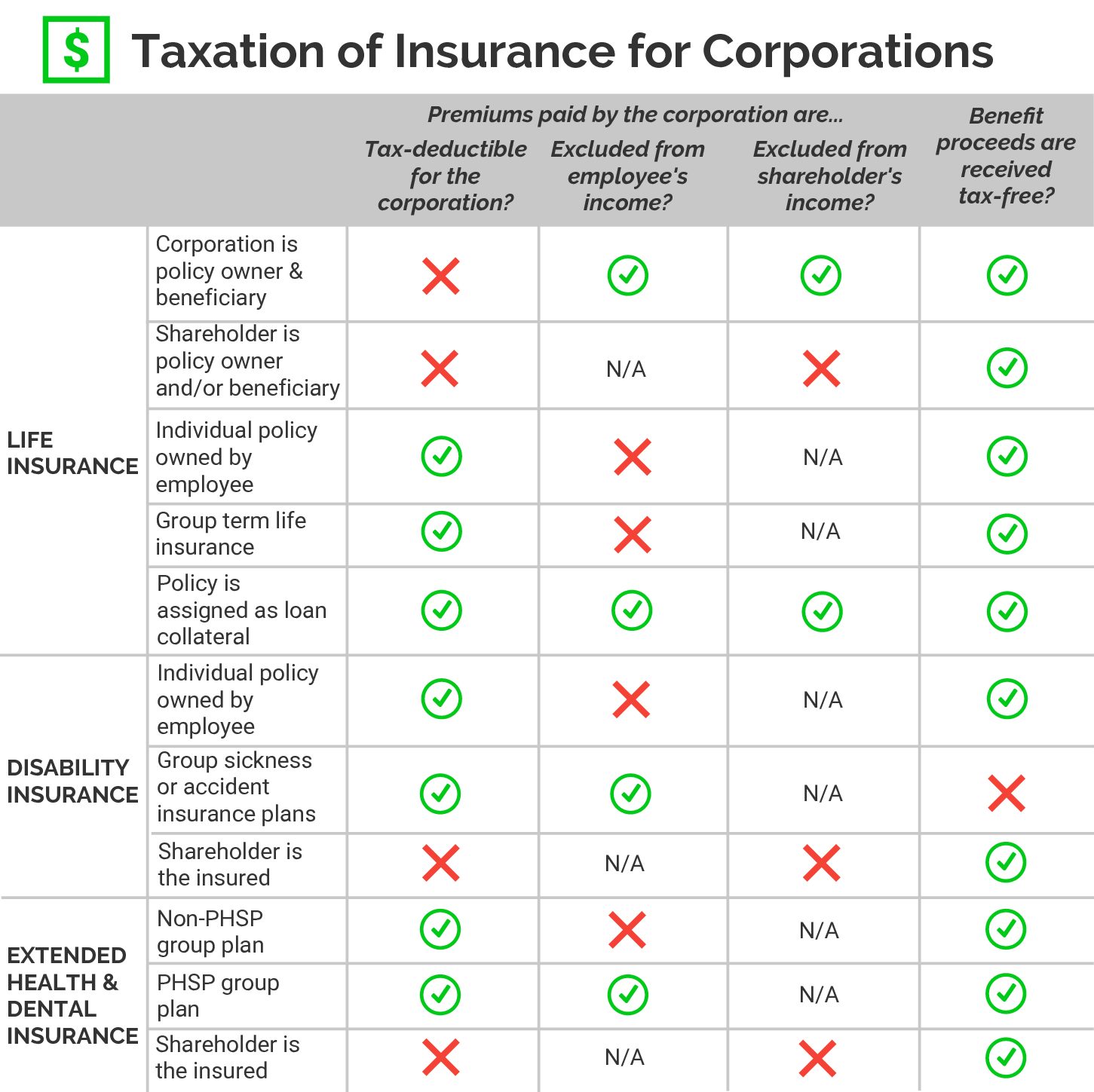

Taxation Of Insurance For Corporations Kelowna Accounting Solutions

Taxation Of Insurance For Corporations Kelowna Accounting Solutions

Is Life Insurance Taxable True Blue Life Insurance

Is Life Insurance Taxable True Blue Life Insurance

How To Speed Up A Life Insurance Payout

How To Speed Up A Life Insurance Payout

How Does A Life Insurance Policy Payout Work Haven Life

How Does A Life Insurance Policy Payout Work Haven Life

The Cost Of Life Insurance Policygenius

The Cost Of Life Insurance Policygenius

4 Life Insurance Tips Everyone Should Know

4 Life Insurance Tips Everyone Should Know

Do You Pay Taxes On Life Insurance Or Do Your Heirs

Do You Pay Taxes On Life Insurance Or Do Your Heirs

Term Insurance Tax Saving Don T Buy Term Insurance Just To Save

Term Insurance Tax Saving Don T Buy Term Insurance Just To Save

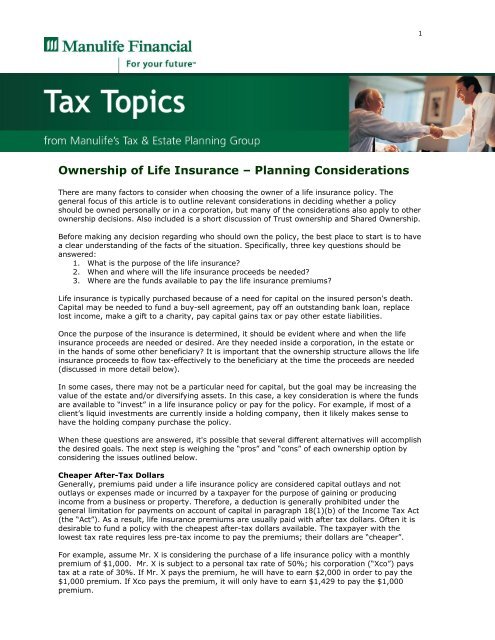

Ownership Of Life Insurance Repsource Manulife Financial

Ownership Of Life Insurance Repsource Manulife Financial

The Best Way To Buy Sell Or Replace Life Insurance

The Best Way To Buy Sell Or Replace Life Insurance

/LifeInsuranceDeathBenefits__GettyImages-1141794014-03431d77c4654c0d9b0712a8cb72e57a.jpg)

Post a Comment for "Do You Pay Tax On Life Insurance Payout"