Federal Definition Of Life Insurance

The federal employees group life insurance fegli program you have several choices in selecting the amount of life insurance thats right for you. In the united states employees can avail themselves of the basic life insurance provided by federal employees group life insurance fegli.

2020 Open Enrollment For Health Insurance 10 Key Facts

2020 Open Enrollment For Health Insurance 10 Key Facts

Section 7702 of the us.

Federal definition of life insurance. Adefinition of life insurance for income tax purposes. Equal to the greater of a your salary rounded up to the next 1000. It is the largest group life insurance program in the world covering over 4 million federal employees and retirees as well as many of their family members.

This definition applies to all policies issued after december 31 1984to qualify as life insurance a policy must meet the definition of life insurance under applicable state or foreign law and must also meet one of two tax tests a cash value accumulation test or a. The federal government established the federal employees group life insurance fegli program on august 29 1954. Code 7702 defines life insurance for federal tax purposes.

Government insurance doesnt just cover the employee but coverage also extends to expenses for injuries suffered by the employees family members. Plus 2000 or b 10000. In 1978 peoples home life insurance company of indianas name changed to federal home life insurance company.

On january 1 2007 federal home life insurance company merged into genworth life and. Life insurance is a contract between an insurer and a policyholder in which the insurer guarantees payment of a death benefit to named beneficiaries upon the death of the insured. Internal revenue code defines what the federal government considers to be a legitimate life insurance contract and determines how such contracts are to be taxed.

If at any time any contract which is a life insurance contract under the applicable law does not meet the definition of life insurance contract under subsection a the income on the contract for any taxable year of the policyholder shall be treated as ordinary income received or accrued by the policyholder during such year. So called mortgage insurance is life insurance which will pay off the remaining amount due on a home loan on the death of the husband or wife. Life insurance proceeds are usually not included in the probate of a dead persons estate but the funds may be counted by the internal revenue service in calculating estate tax.

Life Insurance Check Out Best Insurance Polices 10 Feb 2020

Life Insurance Check Out Best Insurance Polices 10 Feb 2020

Prudential Prudential On Pinterest

Prudential Prudential On Pinterest

Can I Get Non Smoker Life Insurance Rates If I M Only Vaping

Can I Get Non Smoker Life Insurance Rates If I M Only Vaping

The Differences Between Term And Whole Life Insurance

The Differences Between Term And Whole Life Insurance

/types-of-employee-benefits-and-perks-2060433-Final-65c1c14d22de4e10b4f4ea85af6bd187.png) Types Of Employee Benefits And Perks

Types Of Employee Benefits And Perks

How Life Insurance Companies Make Money

How Life Insurance Companies Make Money

Top 10 Life Insurance Companies In The Philippines 2019 Grit Ph

Top 10 Life Insurance Companies In The Philippines 2019 Grit Ph

Top 10 Pros And Cons Of Variable Universal Life Insurance

Top 10 Pros And Cons Of Variable Universal Life Insurance

Insurance Fundamentals For Policymakers Four Assignments

Insurance Fundamentals For Policymakers Four Assignments

Life Insurance Online Discover Best Life Cover Plans Policy In

Life Insurance Online Discover Best Life Cover Plans Policy In

The Differences Between Term And Whole Life Insurance

The Differences Between Term And Whole Life Insurance

Https Www Soa Org Library Newsletters Taxing Times 2011 September Tax 2011 Vol7 Iss3 Pdf

/cdn.vox-cdn.com/uploads/chorus_asset/file/9903901/VRG55WJ_2197..jpg) Why The Future Of Life Insurance May Depend On Your Online

Why The Future Of Life Insurance May Depend On Your Online

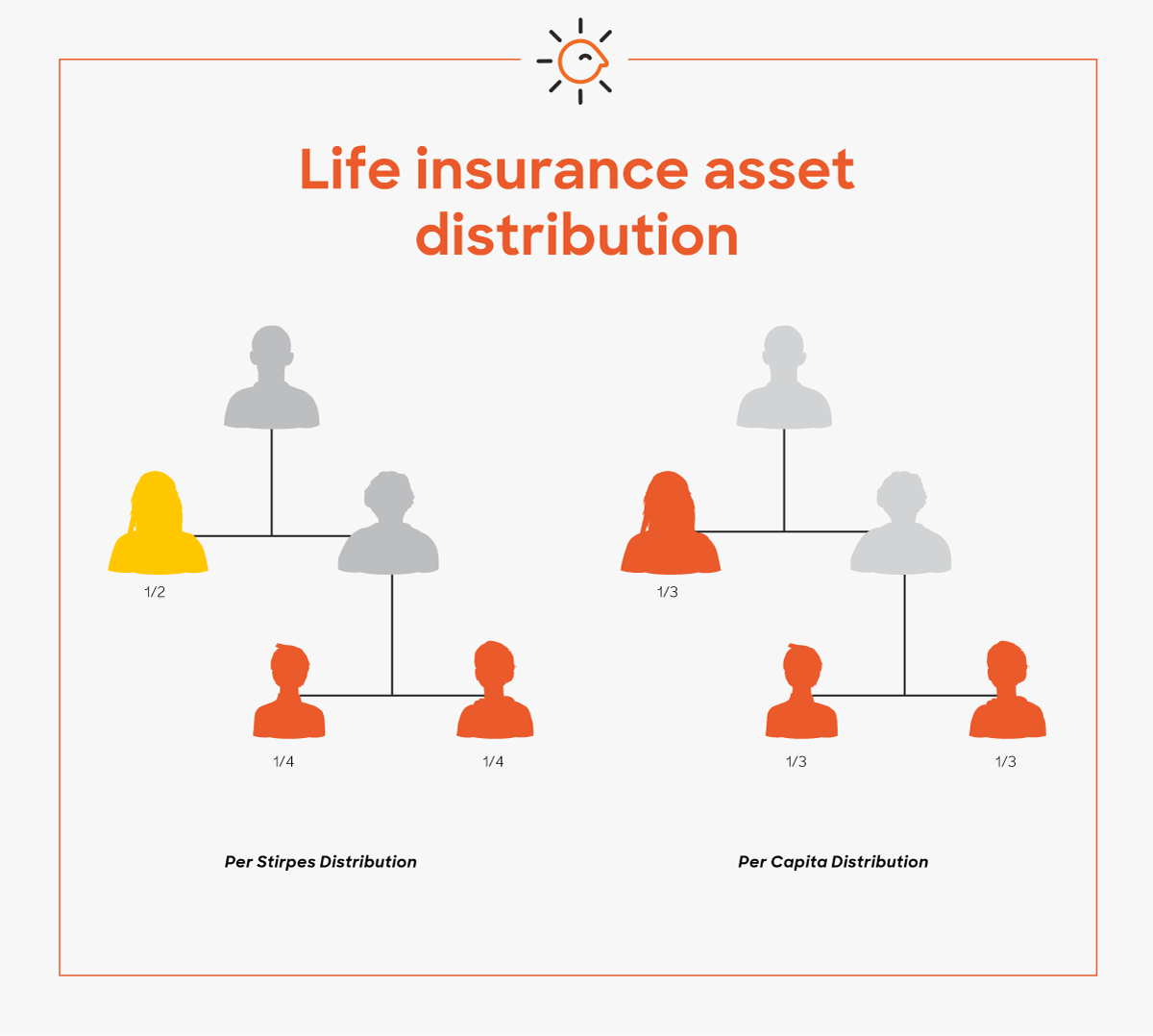

What Happens When Your Life Insurance Beneficiary Dies Before You

What Happens When Your Life Insurance Beneficiary Dies Before You

Top 10 Pros And Cons Of Variable Universal Life Insurance

Top 10 Pros And Cons Of Variable Universal Life Insurance

Life Insurance Corporation Wikipedia

Life Insurance Corporation Wikipedia

Idbi Federal Life Insurance Definition Of Banyan Tree Png Image

Idbi Federal Life Insurance Definition Of Banyan Tree Png Image

Taxes On Life Insurance Here S When Proceeds Are Taxable Bankrate

Taxes On Life Insurance Here S When Proceeds Are Taxable Bankrate

Top 10 Life Insurance Companies In The Philippines 2019 Grit Ph

Top 10 Life Insurance Companies In The Philippines 2019 Grit Ph

/GettyImages-185263144-8aa6cc35d90347b78f97d985afc4d25f.jpg)

Post a Comment for "Federal Definition Of Life Insurance"