Cash Out Life Insurance

Heres everything you need to know about cashing out a life insurance policy. Generally speaking term life insurance has no cash value.

Cash Value In Life Insurance What Is It

Cash Value In Life Insurance What Is It

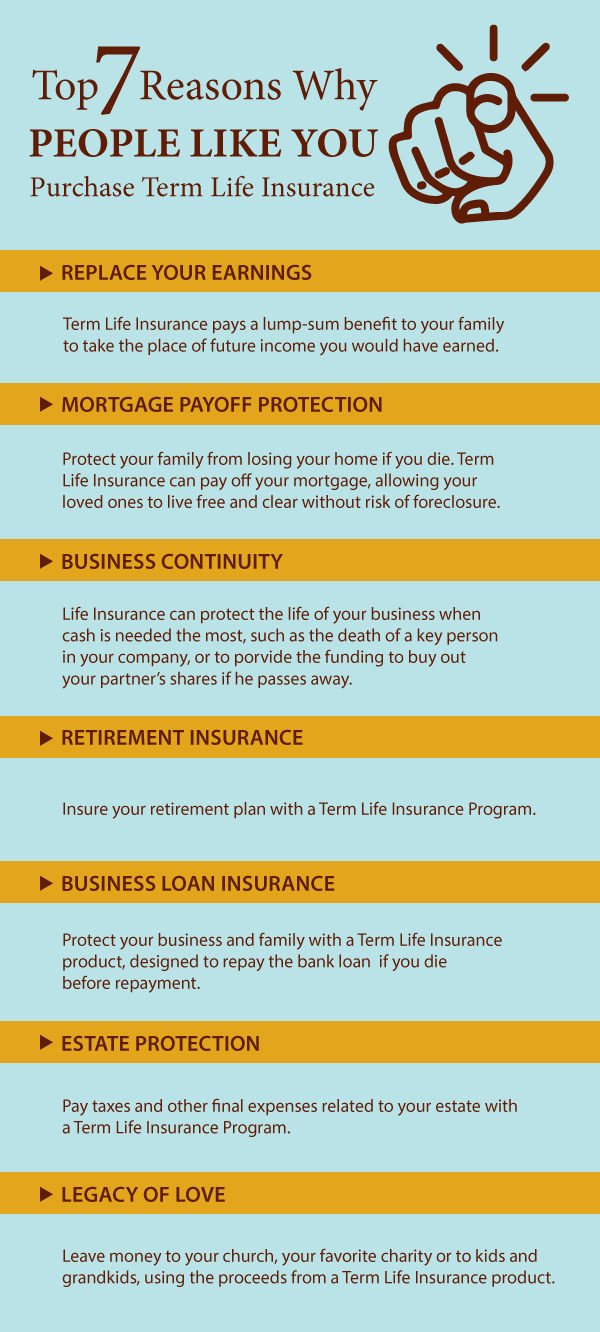

Some people think that once the kids have completed college or you have paid off your mortgage it is time to cancel or reduce life insurance.

Cash out life insurance. Walt disney ray kroc and james cash penney all famously cashed out life insurance policies to start their companies or to keep them afloat during tough times. The most direct way to access the cash value in your policy is to make a withdrawal from it. When to consider a life insurance cash out.

They can help you understand how doing so may affect your financial future. However if you need cash or no longer require coverage there are ways you can cash out of your policy. Whether to cash in a life insurance policy is an important decision.

Other types of insurance let you access funds without needing to show you are suffering from an illness. The choice can have a number of financial implications including tax liability. You can do this by notifying your life insurance carrier that you would like to take money out of your policy.

If you own one of these policies usually called permanent whole or universal life insurance you can cash it out in a relatively simple process. Life insurance provides a death benefit payout to your loved ones in the event that you die. There are a number of factors that determine whether a life insurance cash out makes good financial sense.

Before you decide to sell your life insurance policy for cash if you need to get cash out of your life insurance policy seek the advice of a life settlement broker financial expert and a tax professional. Here are some factors to consider before. Cashing out with cash value.

Baby boomers are living longer and cashing out life. Whole life universal life and variable universal life insurance policies have a feature that offers the potential to build up cash value over time that you can eventually access. Generally if youre in good health have other insurance coverage or have substantial assets that make the policy unnecessary cashing out is an easy way to put some extra money in your pocket.

If you are out of options and must access your life insurance policy its better to withdraw or borrow cash versus surrendering the policy altogether. Some term policies have whats called a return of premium rider that if held for the contract period can return the premium outlay to the policy owner.

5 Options To Cash Out Your Life Insurance Policy Iris

5 Options To Cash Out Your Life Insurance Policy Iris

Hard Time Figuring Out Life Insurance Try These Helpful Ideas

Hard Time Figuring Out Life Insurance Try These Helpful Ideas

What Is Cash Value Life Insurance In 2019 Reviews Om

What Is Cash Value Life Insurance In 2019 Reviews Om

What Is Cash Value Life Insurance Daveramsey Com

What Is Cash Value Life Insurance Daveramsey Com

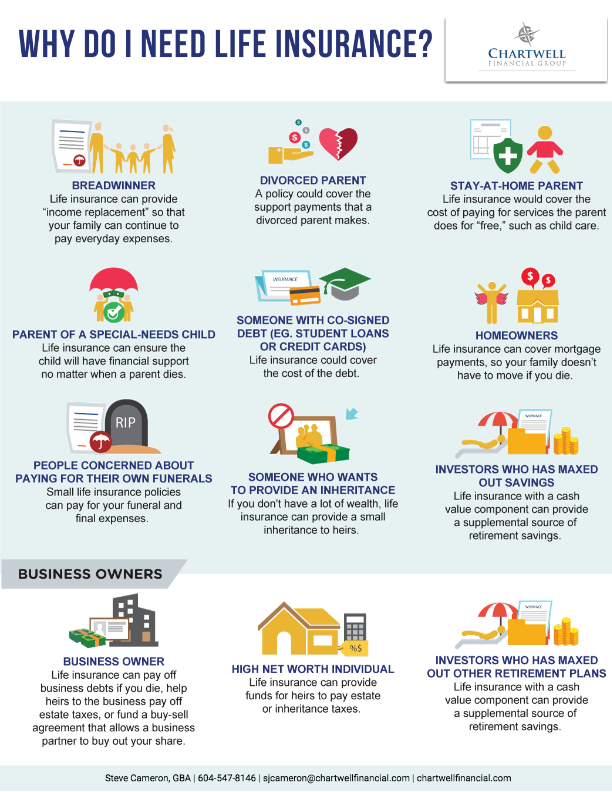

Do You Really Need Life Insurance Chartwell Financial Group

Do You Really Need Life Insurance Chartwell Financial Group

Cash Value Life Insurance Policy Loans Not Such A Good Deal

Cash Value Life Insurance Policy Loans Not Such A Good Deal

Sell Life Insurance Policy For Cash 2020 Guide Magna Life

Sell Life Insurance Policy For Cash 2020 Guide Magna Life

Should You Use Life Insurance To Fund Your Retirement On

Should You Use Life Insurance To Fund Your Retirement On

What Percentage Do You Get When You Cash Out A Whole Life

What Percentage Do You Get When You Cash Out A Whole Life

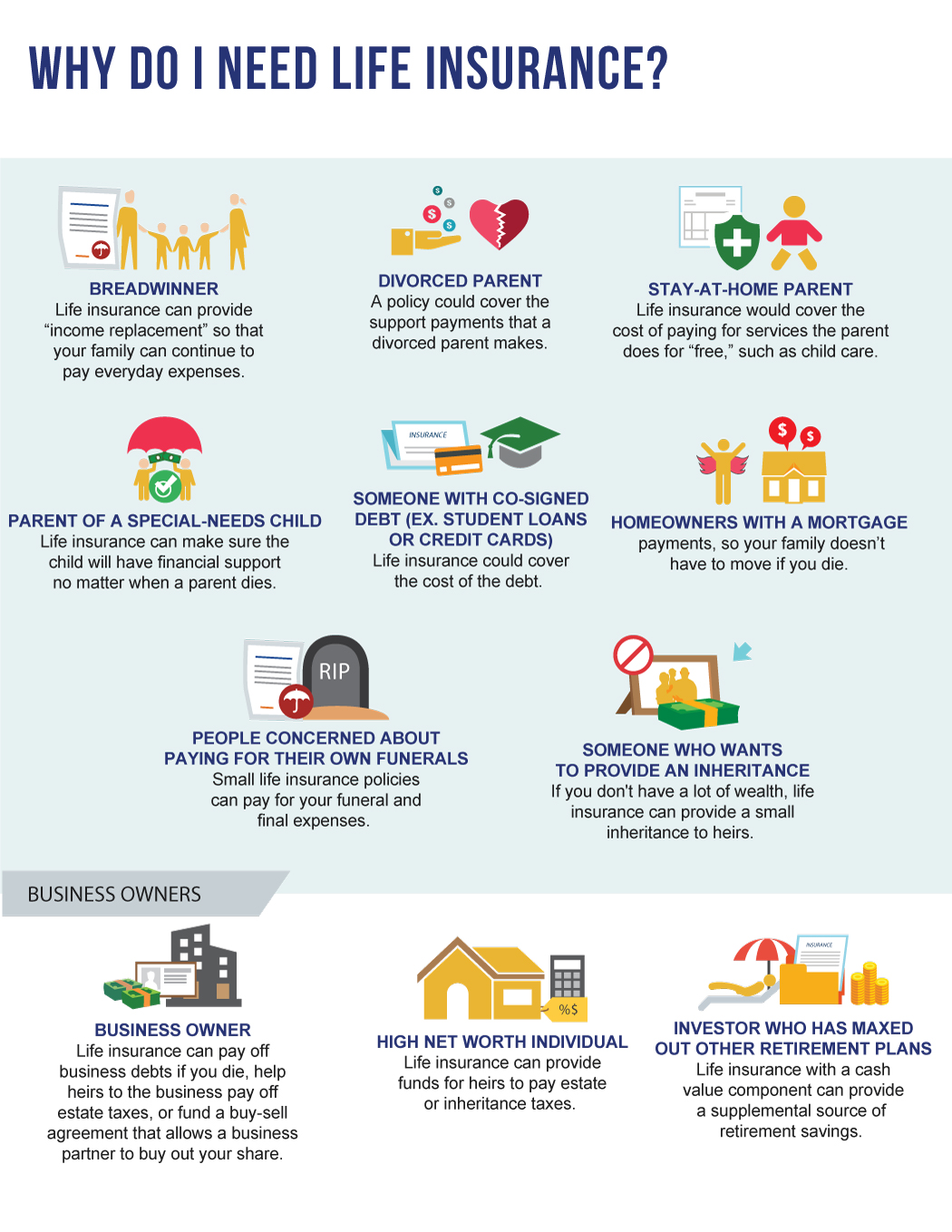

Do You Really Need Life Insurance Legacy Wealth Advisors

Do You Really Need Life Insurance Legacy Wealth Advisors

4 Times Life Insurance Is A Waste Of Money Adulting

4 Times Life Insurance Is A Waste Of Money Adulting

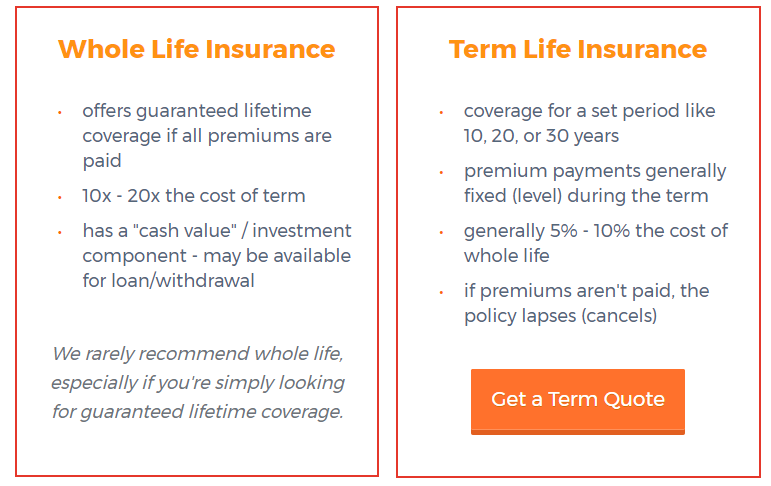

5 Reasons Why Term Life Insurance Is Best Insurance Blog By Chris

5 Reasons Why Term Life Insurance Is Best Insurance Blog By Chris

Leaplife Can You Cash Out Life Insurance

Leaplife Can You Cash Out Life Insurance

Life Insurance If I Cash In My Policy Will I Owe Tax Bankrate Com

Life Insurance If I Cash In My Policy Will I Owe Tax Bankrate Com

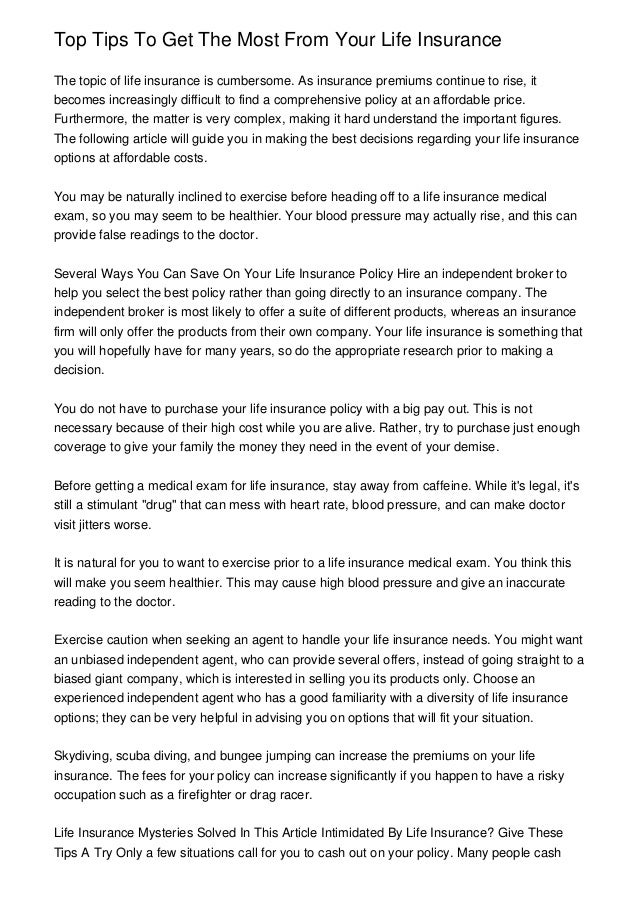

Top Tips To Get The Most From Your Life Insurance

Top Tips To Get The Most From Your Life Insurance

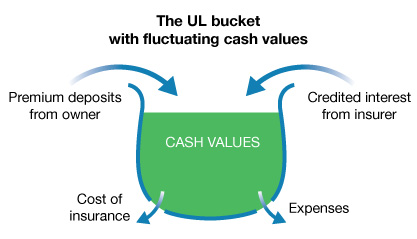

Division Of Financial Regulation Universal Life Premium Life

Division Of Financial Regulation Universal Life Premium Life

The Top Cash Value Life Insurance Tax Benefits For You

The Top Cash Value Life Insurance Tax Benefits For You

Get Them Grandkids Covered With Life Insurance My Official Guide

Get Them Grandkids Covered With Life Insurance My Official Guide

Roth Ira Vs Cash Value Life Insurance Budgeting Money

Roth Ira Vs Cash Value Life Insurance Budgeting Money

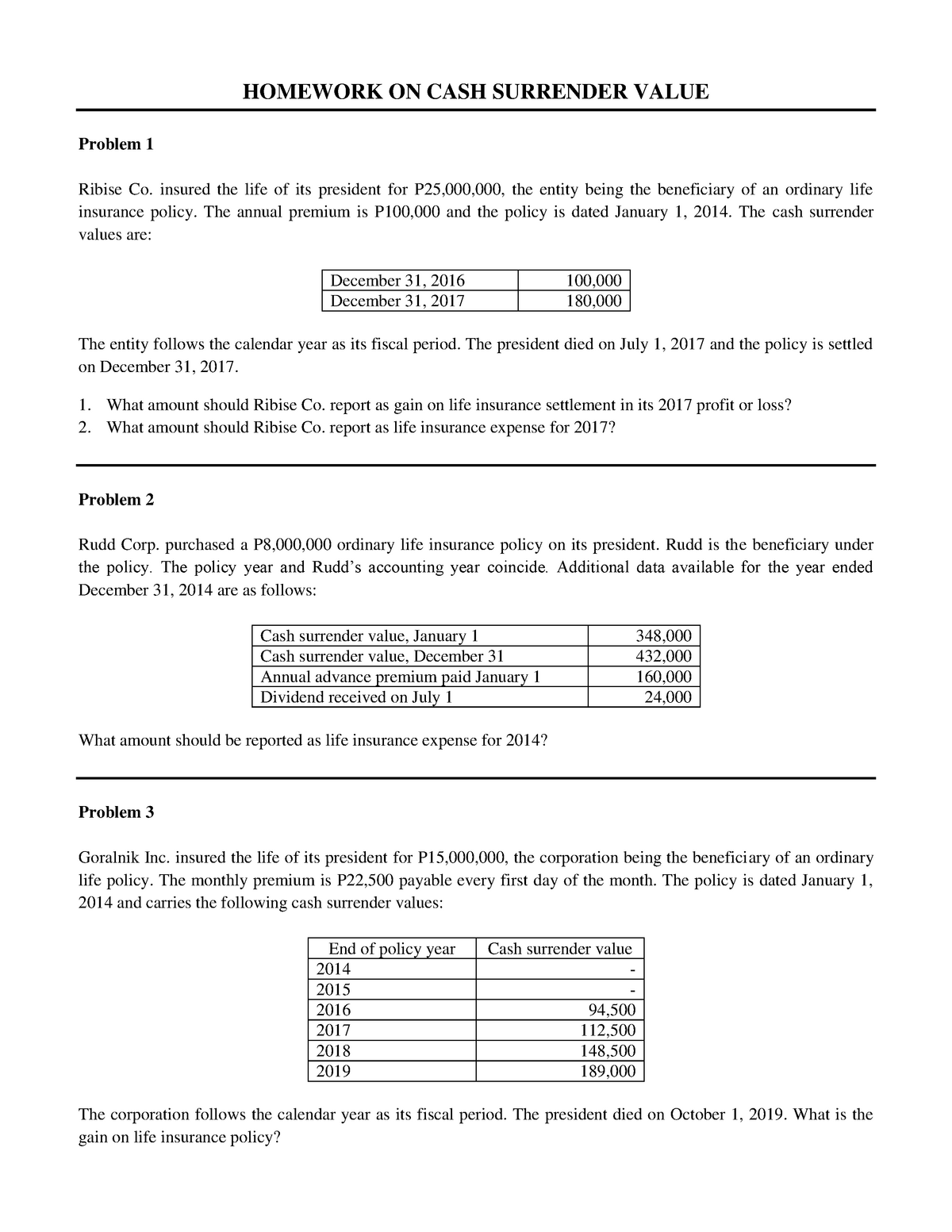

Hw On Cash Surrender Value Accountancy Bsa Dlsu Studocu

Hw On Cash Surrender Value Accountancy Bsa Dlsu Studocu

A Quick Guide To The Gerber Life Insurance Policies Gerber Life

A Quick Guide To The Gerber Life Insurance Policies Gerber Life

Post a Comment for "Cash Out Life Insurance"