Cash Surrender Value Of Life Insurance

Cash value accumulation deferred taxes wendy owns a universal life insurance policy that earns 4000 in interest this policy year. Life insurance comes in two main flavors.

New York Life Insurance Company Reviews How To Calculate Cash

New York Life Insurance Company Reviews How To Calculate Cash

Cash surrender value on a life insurance policy will vary from company to company.

Cash surrender value of life insurance. When you decide to surrender your life insurance policy you are essentially requesting to cancel the life insurance in exchange for any cash value that has accumulated. The two are inherently the same but do not confuse them the difference is that the surrender value is the amount you receive when you choose to cancel or cash out the life insurance policy. Surrender charges can be punitive in the first 5 7 years of a policy and can extend out to 19 years with some companies.

For those who are in need of extra cash there may be options available that you might not be aware. You can use the cash surrender value of life insurance to pay bills address medical expenses or use in case the unexpected occurs. This amount can vary according to a variety of factors.

Cash value or account value is equal to the sum of money that builds inside of a cash value generating annuity or permanent life insurance policy. A term insurance policy provides coverage for a fixed number of years such as 10 or 20 years and then the coverage stops. Because the interest earnings remain inside the life insurance policy wendy will not owe taxes on the 4000 interest earnings on her cash surrender value.

If you arent dead by the end of the term the policy never pays. In this case the surrender value will be less than the cash value. What is life insurance cash surrender value.

It is the money held in your account. Cash surrender value applies to the savings element of whole life insurance policies payable before death. However during the early years of a whole life insurance policy the savings portion.

The cash surrender value in your life insurance policy is essentially the amount of cash that you can withdraw if you surrender your policy to your insurance company and allow it to lapse. When you cash out your policy there may be fees charged by the insurance company. In order to discourage policy holders from pursuing life settlements some insurance companies resort to cash surrender value.

The account value less the surrender charge debited is the surrender value. Fees are taken from the cash value before you get the pay out. Cash surrender value refers to the amount an insurance company will offer an insurance owner who chooses to give back their life.

Ccsb Cash Surrender Value Of Life Insurance Community Svgs

Ccsb Cash Surrender Value Of Life Insurance Community Svgs

How To Calculate The Surrender Value Of Lic Policy Quora

How To Calculate The Surrender Value Of Lic Policy Quora

What Is Cash Surrender Value In Life Insurance Mason Finance

What Is Cash Surrender Value In Life Insurance Mason Finance

Whole Life Insurance Cash Value Chart

Increase In Cash Surrender Value 24000 2017 Jan 1 Life Insurance

Increase In Cash Surrender Value 24000 2017 Jan 1 Life Insurance

Life Insurance And Cash Accumulation Life Insurance Canada

Life Insurance And Cash Accumulation Life Insurance Canada

Cash Surrender Value Definition

Cash Surrender Value Definition

Is Whole Life Insurance Right For You Consumer Reports

Is Whole Life Insurance Right For You Consumer Reports

Foreign Life Insurance Taxable Income Fbar Reportable

Foreign Life Insurance Taxable Income Fbar Reportable

Why Almost Every Life Insurance Policy With Cash Value Stinks

Why Almost Every Life Insurance Policy With Cash Value Stinks

Increase In Cash Surrender Value 24000 2017 Jan 1 Life Insurance

Increase In Cash Surrender Value 24000 2017 Jan 1 Life Insurance

Whole Life Insurance The Essential Guide

Whole Life Insurance The Essential Guide

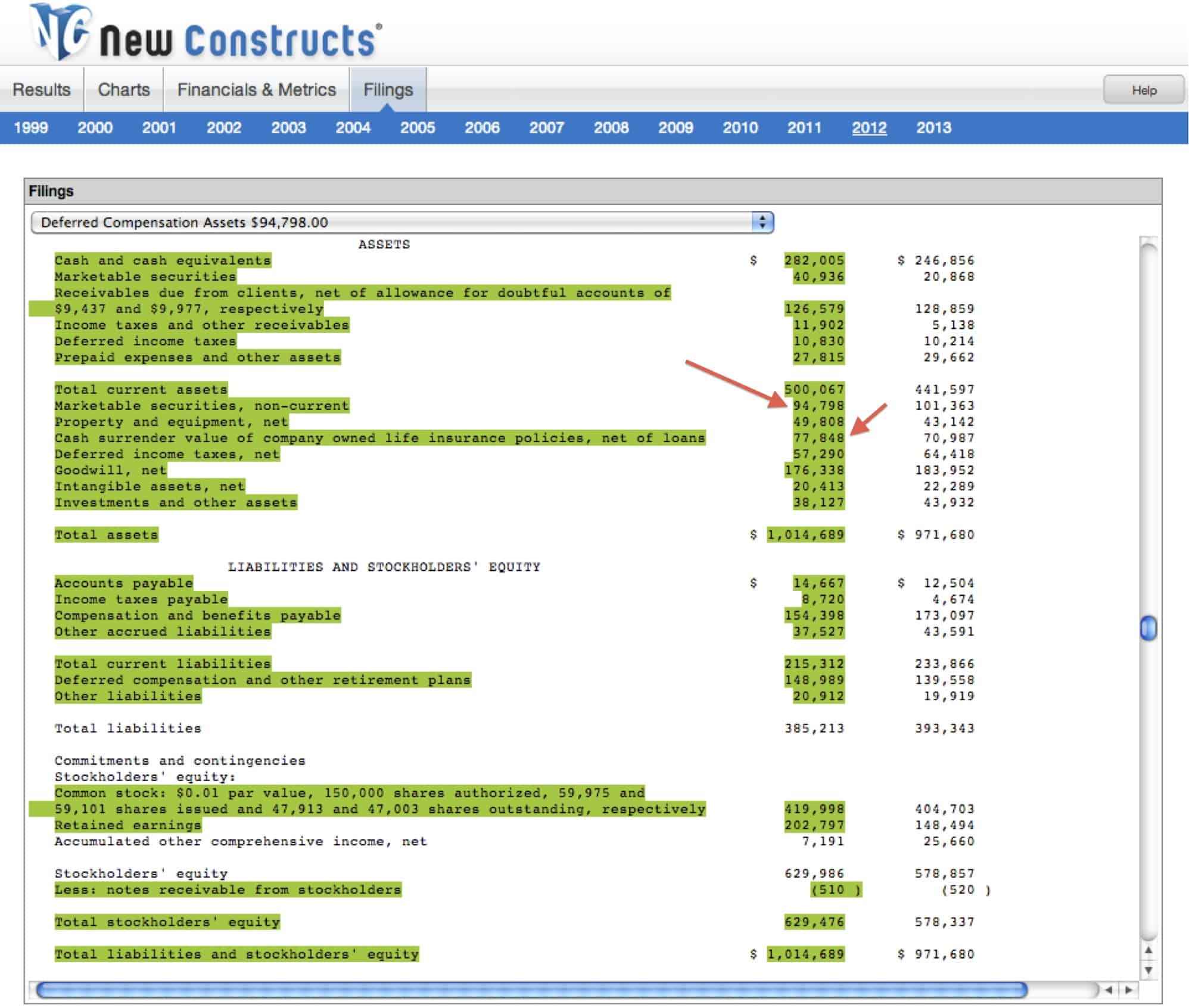

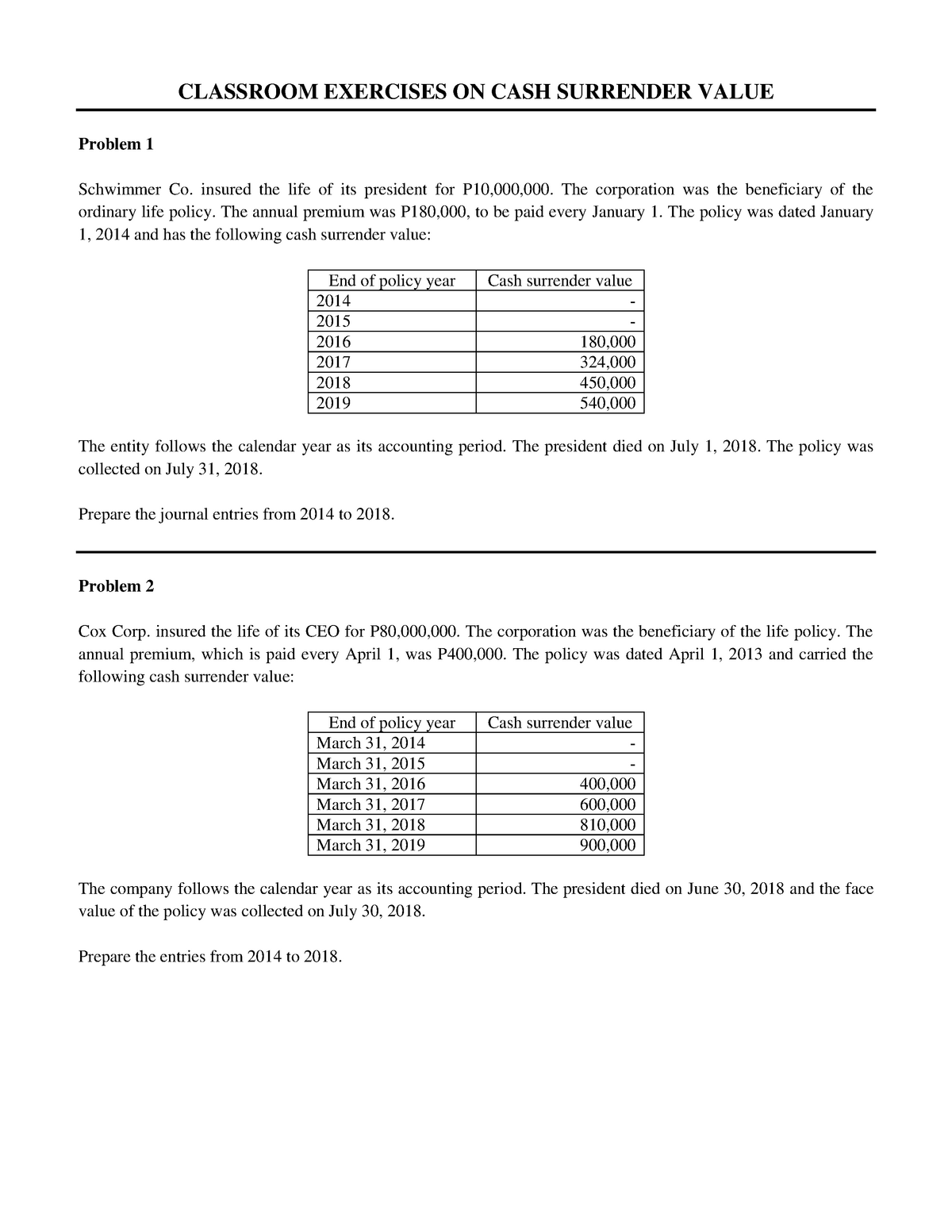

Ce On Cash Surrender Value Accountancy Bsa Dlsu Studocu

Ce On Cash Surrender Value Accountancy Bsa Dlsu Studocu

Accounting Treatment For Life Insurance Policies

Accounting Treatment For Life Insurance Policies

Why There S No Cash Surrender Value Of Term Life Insurance

Why There S No Cash Surrender Value Of Term Life Insurance

Is Cash Surrender Value Of Life Insurance Taxable Fox Business

Is Cash Surrender Value Of Life Insurance Taxable Fox Business

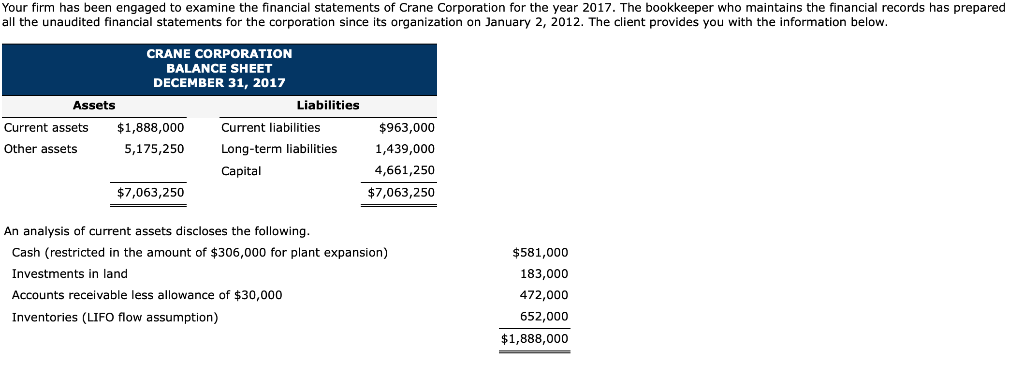

Solved Investments In Land 183000 Cash Surrender Value Of

Solved Investments In Land 183000 Cash Surrender Value Of

8 Marks George 50 Has Purchased A Whole Life Po Chegg Com

8 Marks George 50 Has Purchased A Whole Life Po Chegg Com

Why Equitable S Csv Line Of Credit Is Right For You Pitch

Why Equitable S Csv Line Of Credit Is Right For You Pitch

What Is Universal Life Insurance Insurance Advantage

What Is Universal Life Insurance Insurance Advantage

Post a Comment for "Cash Surrender Value Of Life Insurance"