Cash Value Of Term Life Insurance

The cash value in these policies grows over time as they continue to receive premium payments. Why term life insurance doesnt have a cash value.

Trend In Life Insurance Ownership Rates Any Type Term And Cash

Trend In Life Insurance Ownership Rates Any Type Term And Cash

Universal life insurance.

Cash value of term life insurance. Say youre paying 100 a month for your cash value life insurance policy. Cash value is one of them. In some cases a term policy can be converted to a permanent policy.

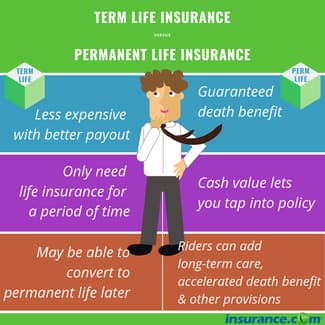

Whats the difference between the two forms of life insurance. Policy holders can choose to receive the cash value as a lump sum or take out a bank loan using the policys cash value as collateral. Permanent life insurance also called cash value life insurance is an entire category of life insurance plans that last as long as you pay the premiums and has a cash value component.

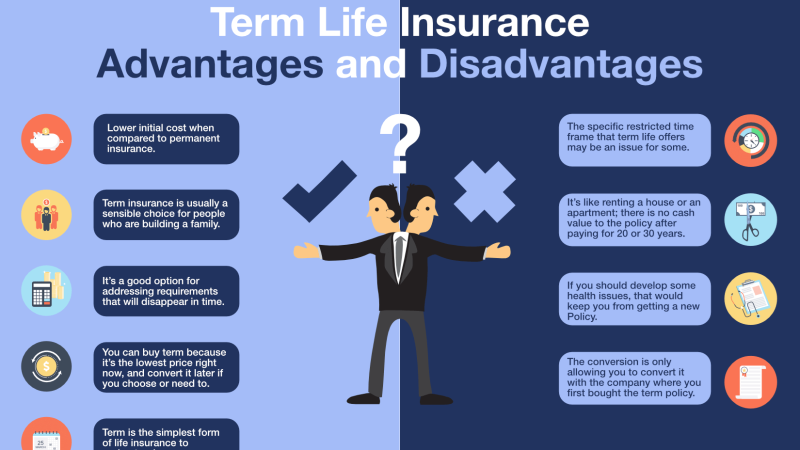

Life insurance whether term or cash value is a way to protect your dependents in the event youre no longer able to contribute to their financial well being. It should be noted that any type of term life insurance policy does not have cash value and only provides pure death benefit protection. This is the most inexpensive type of life insurance and it only pays named beneficiaries upon the death of the insured person.

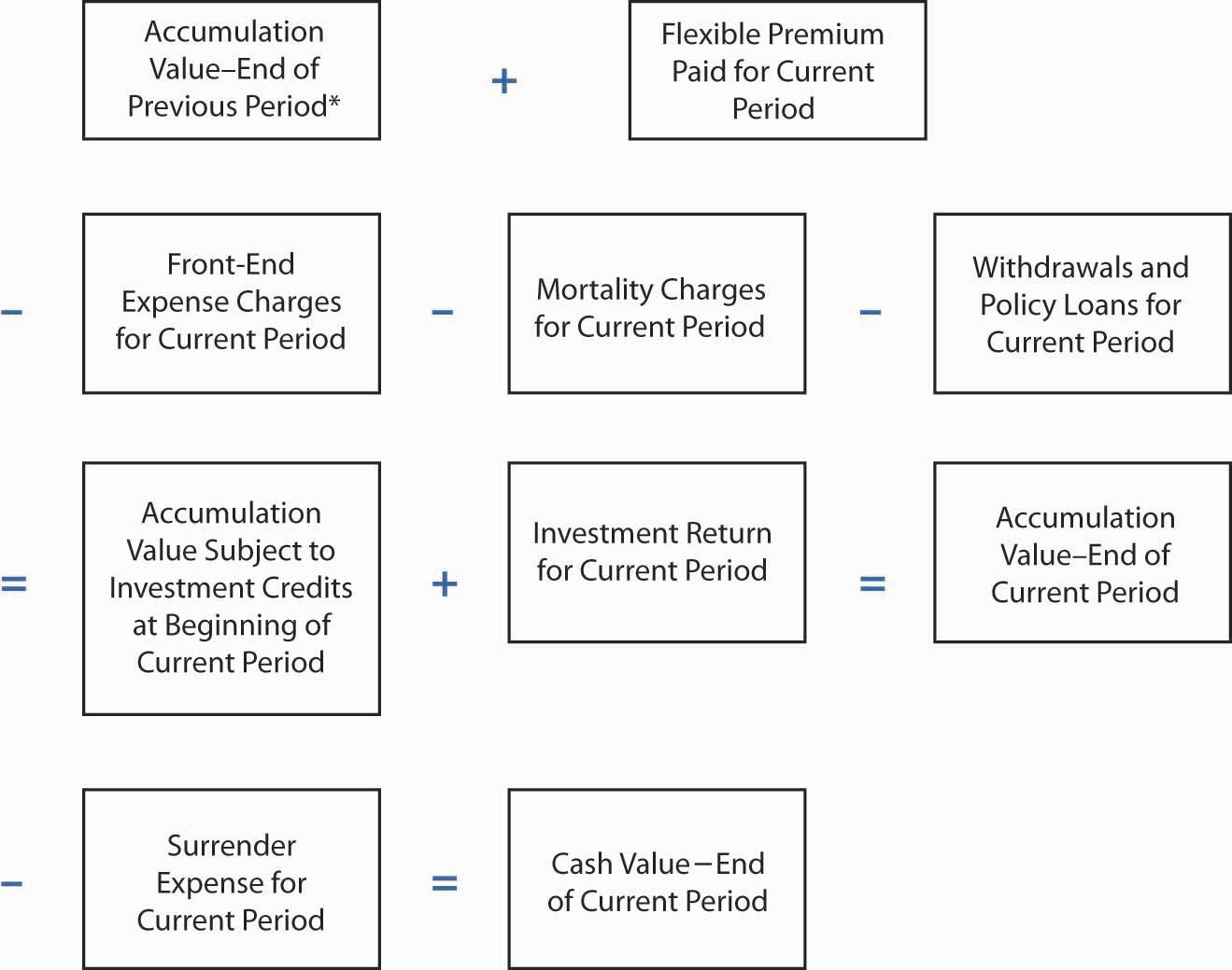

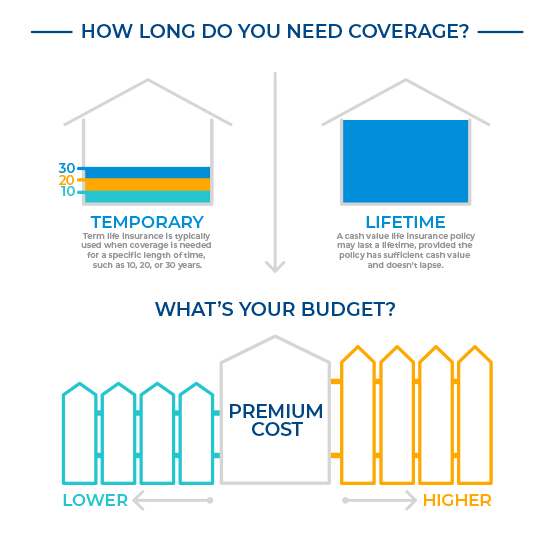

That is you pay premiums at a set rate for a set period of time like 10 20 or 30 years and if you die while youre covered by the policy the insurer will pay your beneficiaries a set amount. Cash value life insurance. Cash value works like this.

Cash value insurance is permanent life insurance because it provides coverage for the policyholders life. Whole life and universal life policies offer this benefit. Some types of life insurance policies including whole life universal life and variable life can accumulate cash value during the policyholders lifetime.

The longer you have the policy the more time your cash value has to grow and earn interest. Term life policies dont. Life insurance can give your family an additional financial safety net.

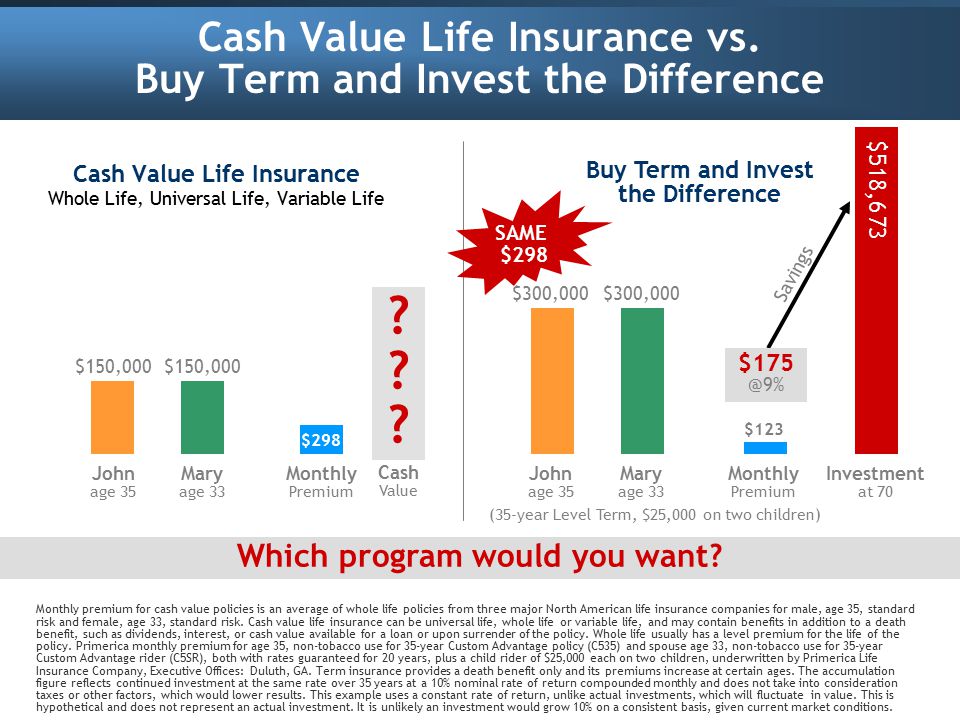

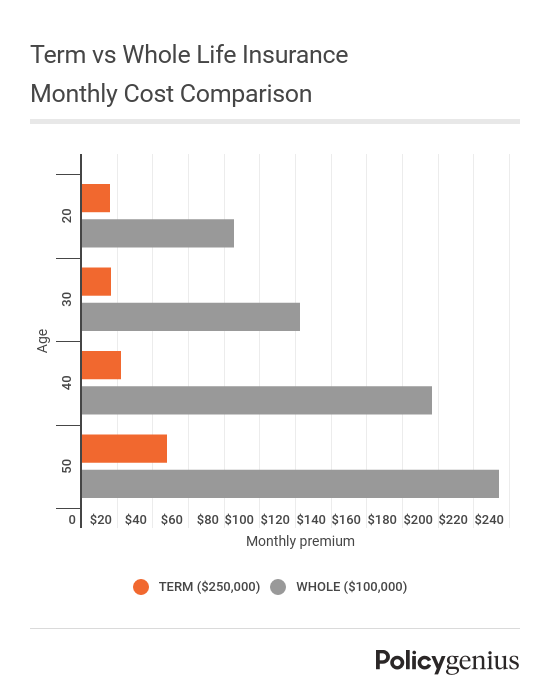

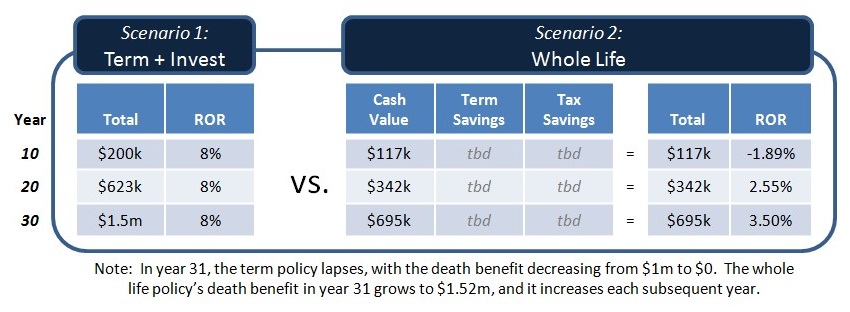

While income replacement is the primary purpose of life insurance many policyholders tap into cash value life insurance for other reasons such as building a nest egg for retirement. Term life insurance does not have a cash value. Traditionally cash value life insurance has higher premiums than term insurance because.

A portion of that 100 covers the cost of actually insuring your life and the rest is put into investments by the insurance company. Term life insurance is what those in the know call pure insurance. There are big differences between term life insurance and the multiple types of permanent life products like whole life and universal life.

These policies are more expensive than term life insurance and the cash value component offers some additional flexibility. And how does cash value life insurance work.

Search Q Term Vs Whole Life Tbm Isch

Whole Or Term Life Insurance The Definitive Guide

Whole Or Term Life Insurance The Definitive Guide

Why Almost Every Life Insurance Policy With Cash Value Stinks

Why Almost Every Life Insurance Policy With Cash Value Stinks

Insurance Atsa Industries United States

Insurance Atsa Industries United States

Guide To How Does Group Term Life Work Life Insurance Canada

Guide To How Does Group Term Life Work Life Insurance Canada

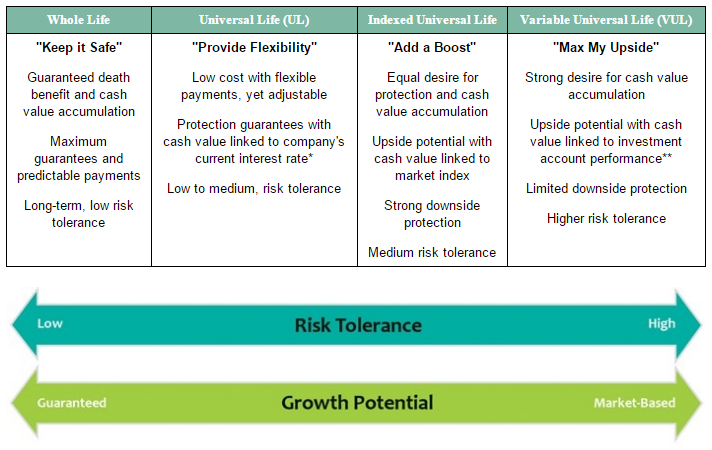

Cash Value Life Insurance Variable Universal Life In 2019 Life

Cash Value Life Insurance Variable Universal Life In 2019 Life

Different Types Of Life Insurance Explanation The Ultimate Guide

Different Types Of Life Insurance Explanation The Ultimate Guide

Make Life Insurance Choice Easier With Financial Planning Unbroke

Make Life Insurance Choice Easier With Financial Planning Unbroke

How To Shop For Life Insurance Should You Buy Term Or Whole Life

How To Shop For Life Insurance Should You Buy Term Or Whole Life

Life Insurance Market Conditions And Life Insurance Products

Life Insurance Market Conditions And Life Insurance Products

Term Life Insurance Advice From Dave Ramsey Get His 1 Tip Here

Term Life Insurance Advice From Dave Ramsey Get His 1 Tip Here

Life Insurance In Your Financial Plan Part 1 Aspen Wealth

Life Insurance In Your Financial Plan Part 1 Aspen Wealth

The Best Life Insurance Companies In 2020 Policygenius

The Best Life Insurance Companies In 2020 Policygenius

Term Insurance Vs Whole Life Insurance Policy

Term Insurance Vs Whole Life Insurance Policy

Life Insurance Term Vs Permanent

Life Insurance Term Vs Permanent

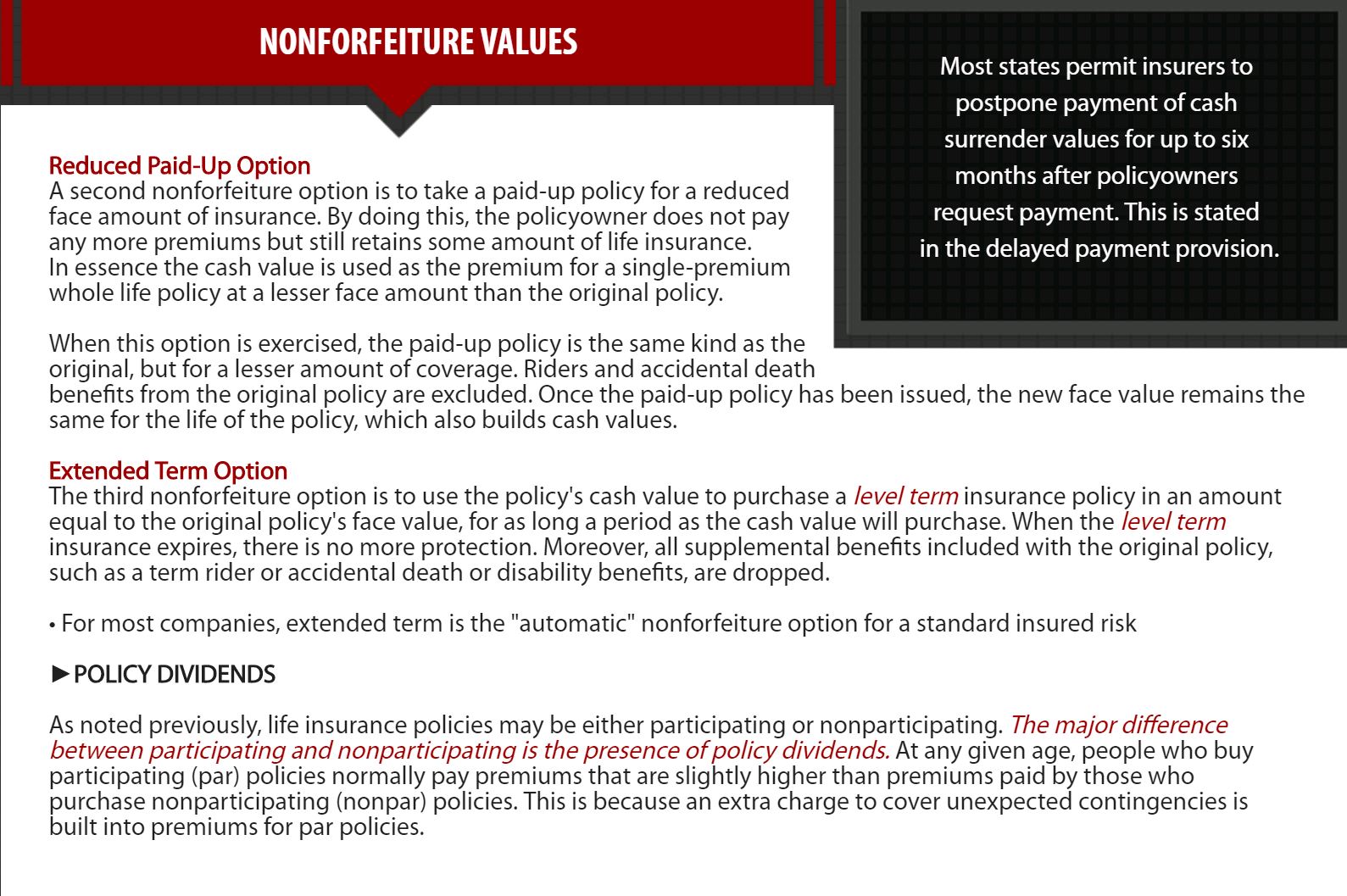

Chapter4 Life Insurance Policies Provisions Options And Riders

Chapter4 Life Insurance Policies Provisions Options And Riders

Life Insurance Basics How To Choose The Right Policy Penn Mutual

Life Insurance Basics How To Choose The Right Policy Penn Mutual

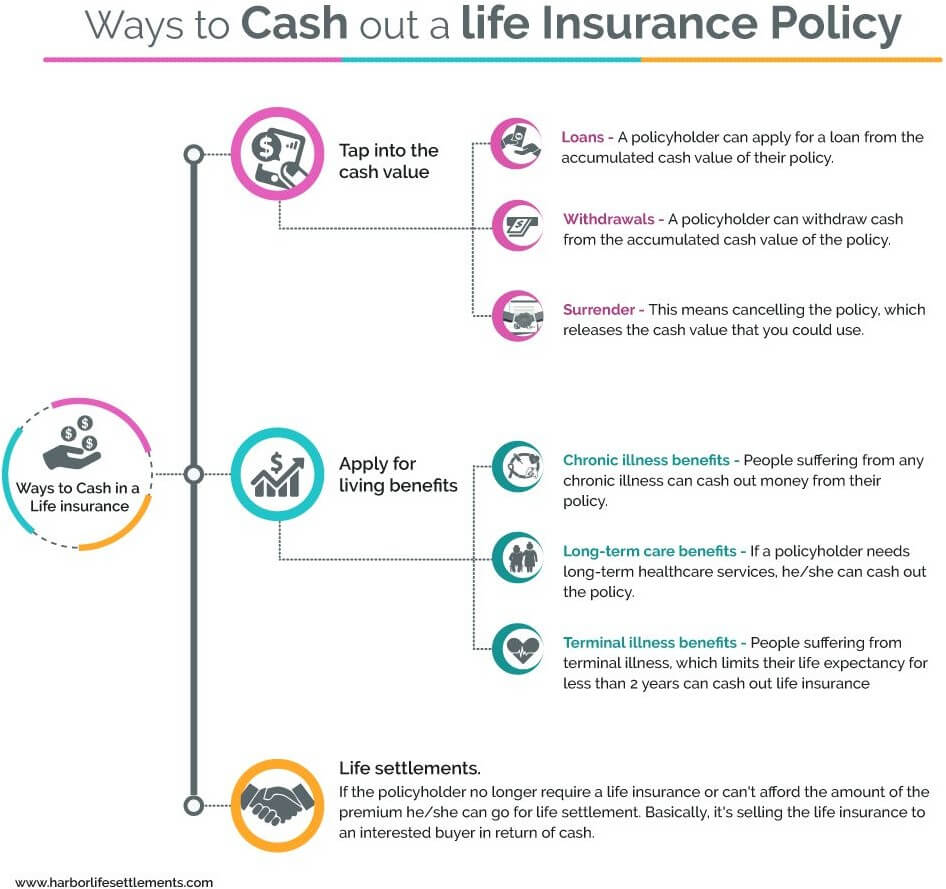

What To Know About Cashing Out Life Insurance Harbor Life

What To Know About Cashing Out Life Insurance Harbor Life

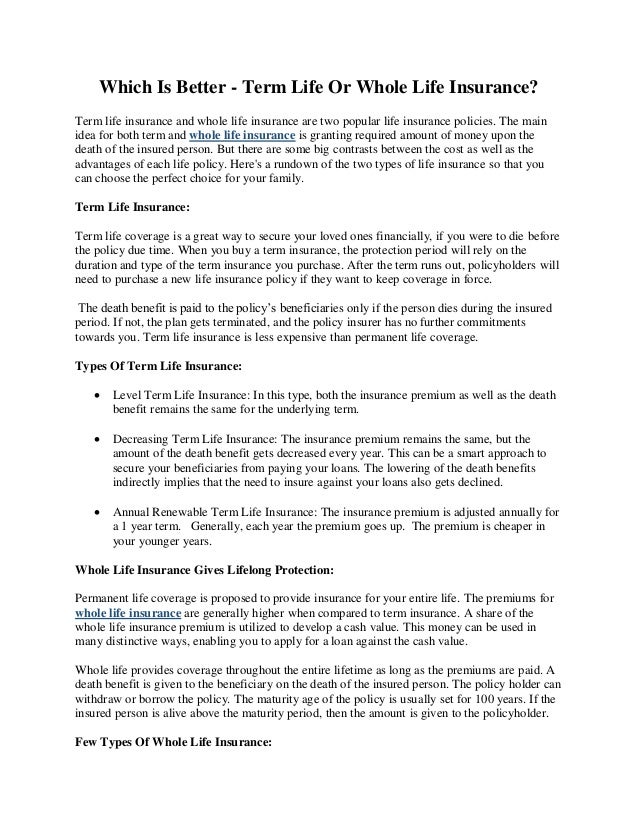

Which Is Better Term Life Or Whole Life Insurance

Which Is Better Term Life Or Whole Life Insurance

Post a Comment for "Cash Value Of Term Life Insurance"