Cashing Out A Life Insurance Policy

Other types of insurance let you access funds without needing to show you are suffering from an illness. Withdrawals loans and premium payment are all options you should consider.

Why Almost Every Life Insurance Policy With Cash Value Stinks

Why Almost Every Life Insurance Policy With Cash Value Stinks

If you have multiple life insurance policies cashing out one of them may not have a significant impact on your familys financial well being.

Cashing out a life insurance policy. Taxes when cashing out a life insurance policy. The best ways to cash out a life insurance policy are to leverage cash value withdrawals take out a loan against your policy surrender your policy or sell your policy in a life settlement or viatical settlement. Cashing out with cash value.

Whole life universal life and variable universal life insurance policies have a feature that offers the potential to build up cash value over time that you can eventually access. Yes cashing out life insurance is possible. Another form notes that the cash out amount may be reduced by the amount of any policy loans or premiums outstanding as well as any cash out fees the insurance company imposes.

Can i cash in a life insurance policy. Some people think that once the kids have completed college or you have paid off your mortgage it is time to cancel or reduce life insurance. Generally you can withdraw a limited amount of cash from your whole life insurance policy.

The most obvious benefit to life insurance is the death benefit what your beneficiaries receive when you die. However some policies such as whole life policies have an investment component that lets you build cash value inside the policy that you can withdraw while. When you cash out a life insurance policy your coverage effectively ends meaning that your spouse andor children will no longer be entitled to any death benefit associated with the policy.

They can help you understand how doing so may affect your financial future. Cashing out a life insurance policy if you are looking for a way to find the right insurance plan then our insurance quotes service can give you quotes on different types of insurance. If you still need your life insurance policy you have other options to withdraw cash and keep your life insurance policy in place.

Youll sign that to acknowledge that youre aware of those consequences. Baby boomers are living longer and cashing out life. If you are out of options and must access your life insurance policy its better to withdraw or borrow cash versus surrendering the policy altogether.

For instance one form lists many of the adverse consequences of cashing out your life insurance. Before you decide to sell your life insurance policy for cash if you need to get cash out of your life insurance policy seek the advice of a life settlement broker financial expert and a tax professional.

What To Know About Cashing Out Life Insurance Harbor Life

What To Know About Cashing Out Life Insurance Harbor Life

Search Q Northwestern Mutual Whole Life Insurance Cash Value Chart Tbm Isch

Cashing Out A Life Insurance Policy

Cashing Out A Life Insurance Policy

5 Steps Before Cashing Out Your Life Insurance Policy Get More Money

5 Steps Before Cashing Out Your Life Insurance Policy Get More Money

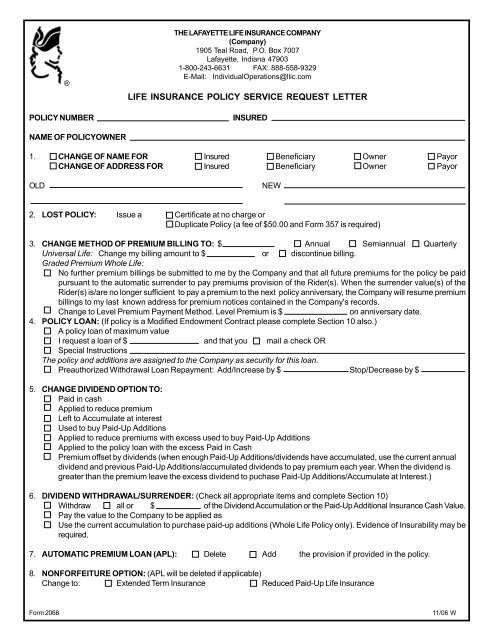

Life Insurance Policy Service Request Letter Secure Your Future

Life Insurance Policy Service Request Letter Secure Your Future

Cashing Out Life Insurance What Are The Advantages And

Cashing Out Life Insurance What Are The Advantages And

Surrendering Your Life Insurance Cash It Out For More With Policy

Surrendering Your Life Insurance Cash It Out For More With Policy

Cashing Out Life Insurance Policy Pros And Cons Fox Business

Cashing Out Life Insurance Policy Pros And Cons Fox Business

5 Options To Cash Out Your Life Insurance Policy Iris

5 Options To Cash Out Your Life Insurance Policy Iris

Should You Use Life Insurance To Fund Your Retirement On

Should You Use Life Insurance To Fund Your Retirement On

What Is Cash Value Life Insurance In 2019 Reviews Om

What Is Cash Value Life Insurance In 2019 Reviews Om

What Are Paid Up Additions The Insurance Pro Blog

What Are Paid Up Additions The Insurance Pro Blog

Hard Time Figuring Out Life Insurance Try These Helpful Ideas

Hard Time Figuring Out Life Insurance Try These Helpful Ideas

Tapping The Cash In Life Insurance Finance Zacks

Tapping The Cash In Life Insurance Finance Zacks

Paid Up Additions Work Magic In A Bank On Yourself Plan

Paid Up Additions Work Magic In A Bank On Yourself Plan

How Cash Value Builds In A Life Insurance Policy

How Cash Value Builds In A Life Insurance Policy

Whole Life Insurance The Essential Guide

Whole Life Insurance The Essential Guide

Difference Between Cash Value And Face Value In Life Insurance

Difference Between Cash Value And Face Value In Life Insurance

Is It Simple To Find Cheap Term Life Insurance

Is It Simple To Find Cheap Term Life Insurance

Cashing In Your Life Insurance Policy

Cashing In Your Life Insurance Policy

How To Switch From Whole To Term Life Insurance Thomas Fenner

How To Switch From Whole To Term Life Insurance Thomas Fenner

How To Sell Your Life Insurance Policy Get More Cash Insurance

How To Sell Your Life Insurance Policy Get More Cash Insurance

Post a Comment for "Cashing Out A Life Insurance Policy"