Credit Life Insurance Mortgage

Credit life insurance is for borrowers of auto or mortgage loans. Mortgage life insurance calculator as its name suggests can calculate the complete mortgage payment.

Pros And Cons Of Group Life Insurance Through Work

Pros And Cons Of Group Life Insurance Through Work

I can envision someone for whom the mortgage is the major concern.

/GettyImages-166836045-5693e7cb3df78cafda85b1c8.jpg)

Credit life insurance mortgage. Getting credit life insurance on a mortgage can be relatively inexpensive and can protect loved ones in. Current credit life and credit disability policy holders please call 1 800 323 5771 or visit protective asset protection. Other folks may say i need a broader product standard life insurance vs.

Mortgage credit life insurance is designed to pay off the balance of a home mortgage upon the death of the insured party. Decreasing term insurance where the size of the policy decreases with the outstanding balance of the mortgage until both reach zero. While the premium is calculated the same way credit life insurance is calculated the actual benefit will be limited to no more than your minimum payment on a credit card.

How to get credit life insurance on a mortgage. These policies are issued for an amount equal to the balance of the. Credit life insurance is typically sold by banks at a mortgage closing.

It is needed in case something unexpected happens to the insurance policy holder. Credit life insurance is exactly what the name implies life insurance that will pay off the amount of debt on a line of credit such as a mortgage or credit card. Credit life insurance pays a policyholders debts when the policyholder dies.

Mortgage calculators use the internal interest rates and combine other charges automatically too. Mortgage life insurance appeals most to people who have an overriding concern about making sure their home loan will be repaid if they die he notes. Unlike term or universal life insurance it doesnt pay out to the policyholders chosen beneficiariesinstead the policyholders creditors receive the value of a credit life insurance policy.

It can be one way to supplement your existing life and disability policies and give you that extra layer of protection. Credit disability insurance is usually not worth the cost of its premium. It could also be offered when you take out a car loan or a line of credit.

To protect your assets you might consider looking at credit insurance for your next loan. There are two basic types of mortgage life insurance.

Mortgage Protection Explained Smith Financial Services Team

Mortgage Protection Explained Smith Financial Services Team

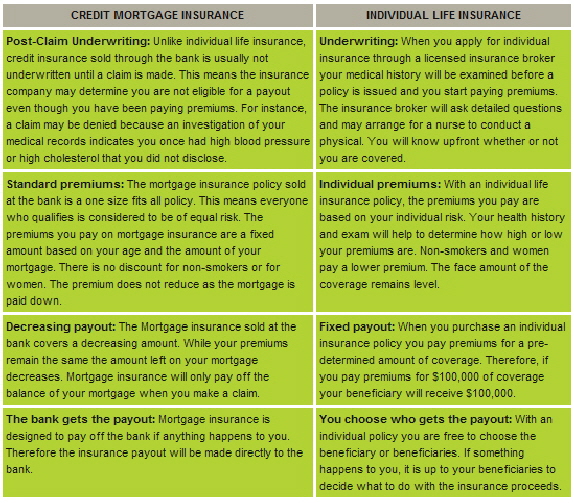

Bank Insurance Premiums Compared To Life Insurance Canada Life

Bank Insurance Premiums Compared To Life Insurance Canada Life

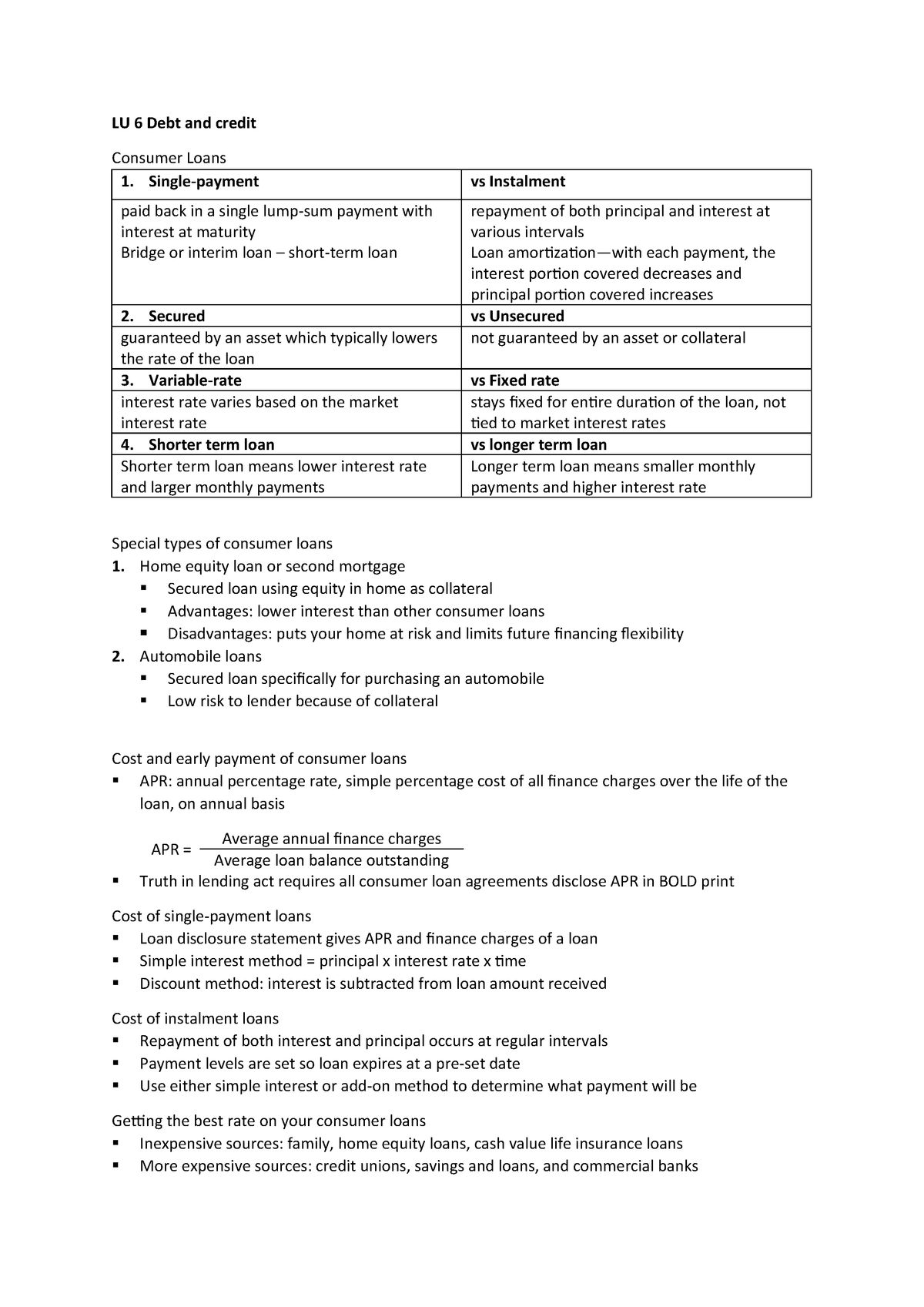

Lu 6 Debt And Credit Summary Smart Money Management Studocu

Lu 6 Debt And Credit Summary Smart Money Management Studocu

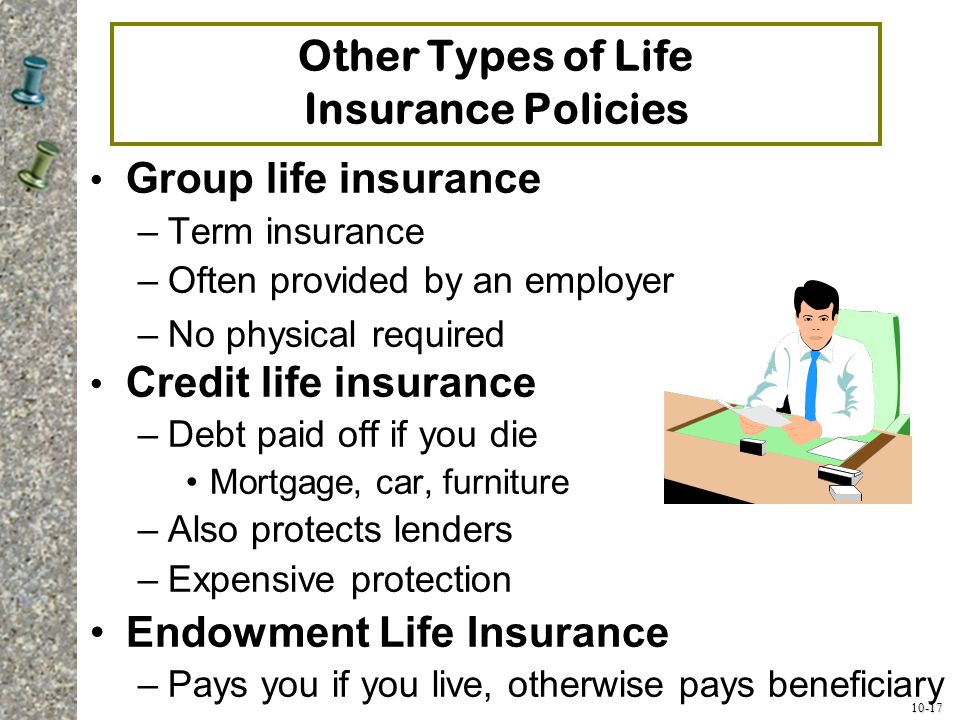

Financial Planning With Life Insurance Ppt Download

Financial Planning With Life Insurance Ppt Download

Https Dfi Wa Gov Sites Default Files Publications Guide Home Loans 0 Pdf

Metlife Direct Life Insurance What Is Credit Life Insurance On A Car

Metlife Direct Life Insurance What Is Credit Life Insurance On A Car

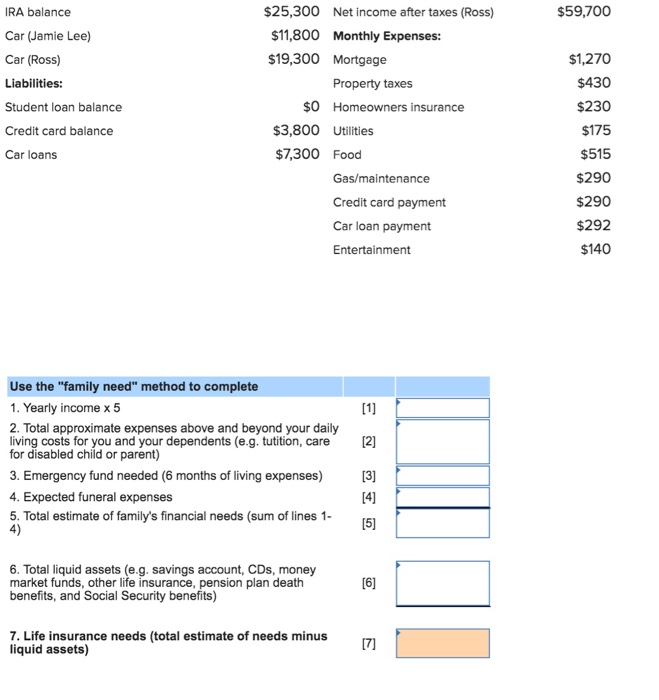

Continuing Case 53 Life Insurance Needs Surprise Chegg Com

Continuing Case 53 Life Insurance Needs Surprise Chegg Com

Mortgages Investments Life Insurance By Divine Mortgage Group In

/GettyImages-166836045-5693e7cb3df78cafda85b1c8.jpg) Here Is What Happens To Credit Card Debt When You Die

Here Is What Happens To Credit Card Debt When You Die

Termlife Insurance For Home Read This Before You Choose Your

Termlife Insurance For Home Read This Before You Choose Your

What Is Mortgage Life Insurance

What Is Mortgage Life Insurance

Credit Life Credit Shield Mortgage Insurance

Credit Life Credit Shield Mortgage Insurance

Can You Buy Credit Life Insurance On A Home Mortgage At Any Age

Can You Buy Credit Life Insurance On A Home Mortgage At Any Age

Copyright C 2008 Pearson Education Canada 5 1 Credit Life

Copyright C 2008 Pearson Education Canada 5 1 Credit Life

Term Life Vs Whole Life Insurance Daveramsey Com

Term Life Vs Whole Life Insurance Daveramsey Com

Jones Dooley Insurance Brokers Quotes Life And Mortgage

Jones Dooley Insurance Brokers Quotes Life And Mortgage

What Is Mortgage Insurance How It Works When It S Required

What Is Mortgage Insurance How It Works When It S Required

Credit Life Insurance Is It Worth It Rates Ca Resources News

Credit Life Insurance Is It Worth It Rates Ca Resources News

:max_bytes(150000):strip_icc()/GettyImages-1143762481-92466e5f4b614a6a8b466fb0993af6d2.jpg)

Post a Comment for "Credit Life Insurance Mortgage"