Equity Indexed Universal Life Insurance Pros And Cons

But financial experts warn this product which was first introduced in 1997 is not for everyone. This extensive article explains what is iul how it works and the pros and cons of an indexed universal life policy.

Why We Don T Recommend Indexed Universal Life Insurance

Why We Don T Recommend Indexed Universal Life Insurance

An indexed universal life insurance policy is a permanent life insurance policy that offers death benefit protection and cash value growth.

Equity indexed universal life insurance pros and cons. Insurance as an investment. What is equity indexed universal life insurance. Its not for most people but its important to understand the positives and negatives of this kind of hybrid life insurance policy.

What are the pros and cons of indexed universal life insurance. Indexed universal life insurance is often pitched as a cash value insurance policy that benefits from the markets gainstax freewithout the risk of loss during a market downturn. Indexed universal life can be used as both protection for your family and as an investment.

Unlike whole life insurance which has relatively low returns indexed universal life insurance has the potential for greater gains due to investing in the stock market. Indexed universal life pros and cons are typically exaggerated by both sides with agendas to either sell an iul policy or against it. Every type offers positives and negatives and my goal is to unveil one of the newest options equity indexed universal life insurance or eiul.

In creating this post we dug through all iul pros and cons we could find on google and youtube to address each thoroughly. Interest is credited to your policy via a declared fixed rate or based on a formula that tracks the movement of a selected stock market index over a particular time frame. Term life whole life and universal life to name a few.

There are so many options. What are the pros and cons of equity indexed universal life insurance. Indexed universal life insurance is getting a lot of interest among those looking for a little investment action with their life insurance protection these days.

Iul also known as equity indexed. Equity indexed universal life insurance is a type of policy which affords the policyholder the opportunity to invest the cash value in index options that follow the movement of an index such as the dow jones industrial average. According to limra indexed universal life insurance policy premiums increased 23 in 2014.

First and foremost an eiul is a life insurance policy.

Top 100 Life Insurance Direct Quote Index Squidhomebiz

Top 100 Life Insurance Direct Quote Index Squidhomebiz

Pros And Cons Of Indexed Universal Life Insurance

Pros And Cons Of Indexed Universal Life Insurance

14 Best Universal Life Insurance Images Universal Life Insurance

14 Best Universal Life Insurance Images Universal Life Insurance

Universal Life Insurance Definition

Universal Life Insurance Definition

Indexed Universal Life Vs Whole Life Which Policy Is Best For You

Indexed Universal Life Vs Whole Life Which Policy Is Best For You

Lifepro Blog Breaking Life Insurance And Annuity News Page 2

Lifepro Blog Breaking Life Insurance And Annuity News Page 2

Independent Agent S Guide To Indexed Universal Life Insurace 2019

Independent Agent S Guide To Indexed Universal Life Insurace 2019

The Link Between Stock Market Indexes And Life Insurance Policies

The Link Between Stock Market Indexes And Life Insurance Policies

Index Universal Life Iul Pros Cons 2020 Review Pinnaclequote

Index Universal Life Iul Pros Cons 2020 Review Pinnaclequote

Lifepro Blog Breaking Life Insurance And Annuity News Page 10

Lifepro Blog Breaking Life Insurance And Annuity News Page 10

What Is Universal Life Insurance

What Is Universal Life Insurance

How Does Cash Value Life Insurance Work Pros And Cons

How Does Cash Value Life Insurance Work Pros And Cons

Universal Life Insurance Compare The Best Online Rates Available

15 Indexed Universal Life Insurance Pros And Cons Vittana Org

15 Indexed Universal Life Insurance Pros And Cons Vittana Org

Guaranteed Universal Life Insurance Pros Cons And Overview

Guaranteed Universal Life Insurance Pros Cons And Overview

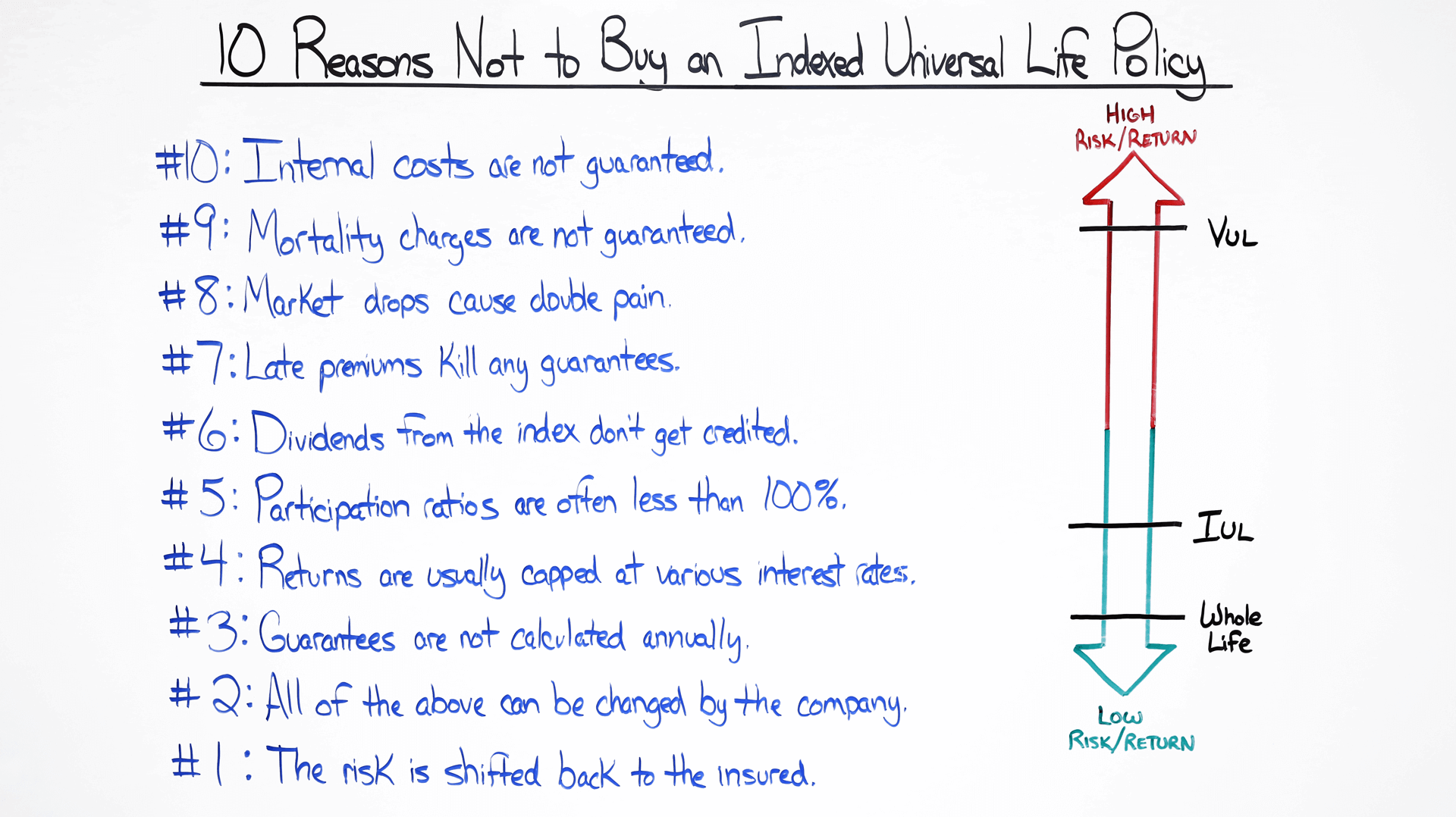

Drawbacks Of Iul Policies Indexeduniversal Life

Drawbacks Of Iul Policies Indexeduniversal Life

Pros And Cons Of Universal Life Insurance Policy Tipsever

Pros And Cons Of Universal Life Insurance Policy Tipsever

Indexed Universal Life Iul Insurance Nrilifeinsurance

Indexed Universal Life Iul Insurance Nrilifeinsurance

Top 12 Pros And Cons Of Indexed Universal Life Iul Insurance

Top 12 Pros And Cons Of Indexed Universal Life Iul Insurance

Top 12 Pros And Cons Of Indexed Universal Life Iul Insurance

Top 12 Pros And Cons Of Indexed Universal Life Iul Insurance

Universal Life Insurance Ultimate Guide To Benefits Pros Cons

Universal Life Insurance Ultimate Guide To Benefits Pros Cons

/GettyImages-926129268-635036cfea674e89bd4153eda9c0f951.jpg)

Post a Comment for "Equity Indexed Universal Life Insurance Pros And Cons"