Deduct Life Insurance Premiums

While the irs allows llcs to deduct most of the insurance premiums associated with business expenses life insurance premiums are not eligible. Deductible employer paid life insurance premiums.

Payroll Taxes And Employer Responsibilities

Payroll Taxes And Employer Responsibilities

Generally speaking a business can deduct its life insurance premiums if they are paid on behalf of and for the benefit of someone other than the business.

Deduct life insurance premiums. Self employed people and freelancers are not eligible to deduct their life insurance premiums as a business expense either. However if youre the owner of an llc and are paying life insurance premiums for employees these premiums may be deductible. Heres a look at what the canada revenue agency requires.

You cant deduct premiums on some life insurance and annuities. They fall under the same considerations as individual policies. In this situation the life insurance benefit is also a taxable fringe benefit.

You are included among potential beneficiaries. However if you are a business owner and you pay life insurance premiums on behalf your employees your expenses may be deductible. Deductible life insurance premiums as long as employees are the beneficiaries s corporations are allowed to deduct life insurance premiumsif the employee dies the s corporation cannot receive any sort of compensation or payment from the life insurance plan.

However in certain situations involving employee benefits and other corporate arrangements some of the. However if the business is the beneficiary such as in corporate owned life insurance coli or bank owned life insurance boli the tax consequences may be different. Life insurance policy premiums do not typically qualify as eligible income tax deductions.

However employers offering group term life coverage to employees can deduct premiums they pay on the first 50000 of benefits per employee and amounts up to this limit are not counted as income. Are key person life insurance premiums a deductible as a business expense. However it also comes with many expenses.

For policies issued before june 9 1997 you cant deduct the premiums on a life insurance policy covering you an employee or any person with a financial interest in your business if you are directly or indirectly named as a beneficiary of the policy. Can i deduct life insurance if i am self employed. As an individual when you pay life insurance premiums they are not deductible on your income tax return.

However a deduction is permitted where an insurance policy is collaterally assigned by the policyholder to secure a loan used by the policyholder to earn income from a business or property. Premiums payable under a life insurance policy are generally not deductible for income tax purposes. Being self employed allows you the freedom to set your own hours and choose your own projects.

Net Pay Pf L2 Objectives Calculate Net Pay Learning Outcome B Ppt

Net Pay Pf L2 Objectives Calculate Net Pay Learning Outcome B Ppt

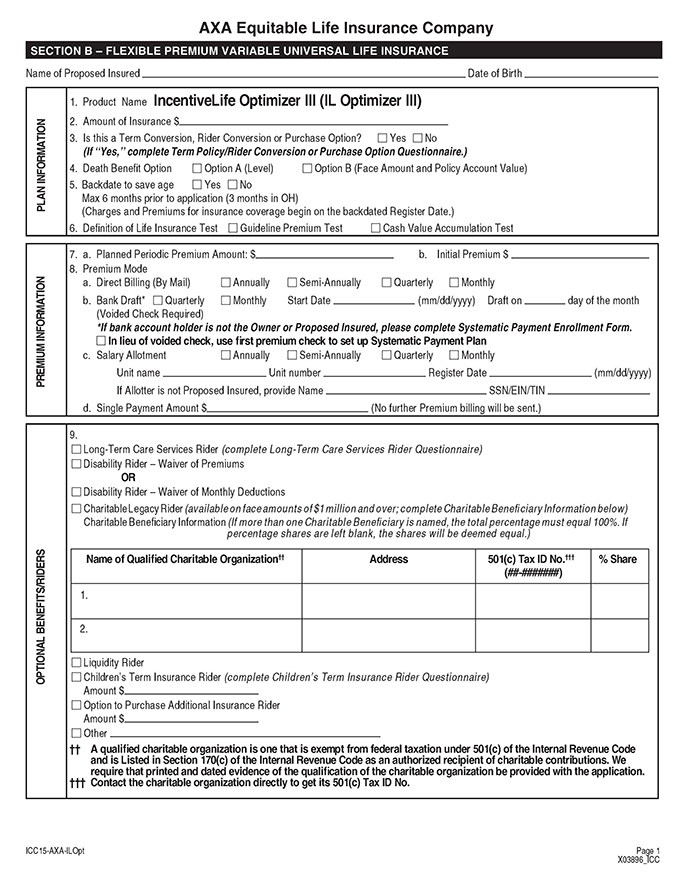

Form Of Application Icc15 Axa Ilopt

Form Of Application Icc15 Axa Ilopt

Health Insurance Tax Deductions Save Money Do You Qualify

Health Insurance Tax Deductions Save Money Do You Qualify

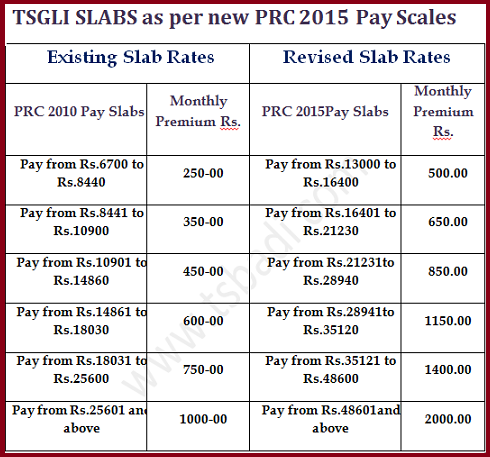

Go 49 Tsgli Slabs Tsgli Compulsory Premium Deductions Rps 2015

Go 49 Tsgli Slabs Tsgli Compulsory Premium Deductions Rps 2015

How To Donate Big In Charitable Giving With Smallest Dollar By

How To Donate Big In Charitable Giving With Smallest Dollar By

Life Insurance Tax Benefit Tax Deduction Rules Of Life Insurance

Life Insurance Tax Benefit Tax Deduction Rules Of Life Insurance

Whether Your Life Insurance Policy Is Eligible For Tax Saving

Whether Your Life Insurance Policy Is Eligible For Tax Saving

Health Insurance Tax Deductions Save Money Do You Qualify

Health Insurance Tax Deductions Save Money Do You Qualify

Know All About Life Insurance Premium Expenses Section80c Com

Know All About Life Insurance Premium Expenses Section80c Com

Tds Life Insurance Budget 2019 Proposes 5 Tds For Taxable Life

Tds Life Insurance Budget 2019 Proposes 5 Tds For Taxable Life

Philippines General Insurance Continued Pdf Free Download

Philippines General Insurance Continued Pdf Free Download

Deduction For Medical Care Expenditures Coca Cola Bottlers Japan

Deduction For Medical Care Expenditures Coca Cola Bottlers Japan

Income Tax On Maturity Amount Of Life Insurance Policy Simple

Income Tax On Maturity Amount Of Life Insurance Policy Simple

Which Is A Good Investment Plan For Under 80c Quora

Personal Income Tax Deduction Life And Private Medical Insurance

Personal Income Tax Deduction Life And Private Medical Insurance

Health Insurance Tax Benefits U S 80d For Fy 2018 19 Ay 2019 20

Health Insurance Tax Benefits U S 80d For Fy 2018 19 Ay 2019 20

80c Deduction On Surrender Of Life Insurance Policy Ulip Before

80c Deduction On Surrender Of Life Insurance Policy Ulip Before

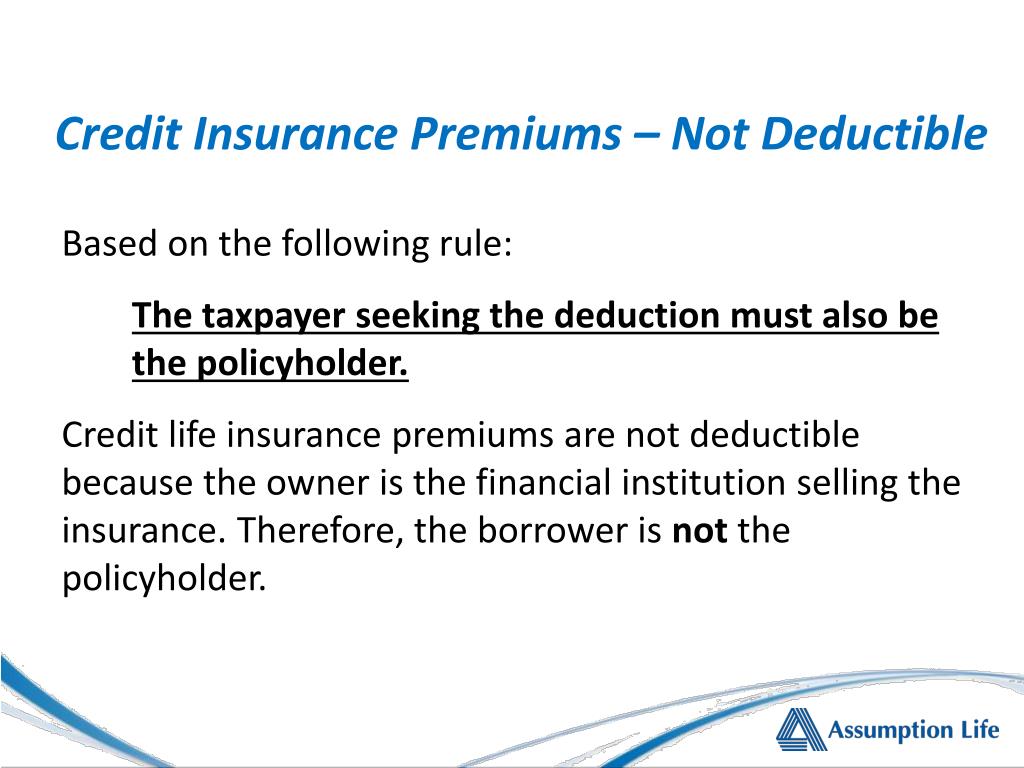

Ppt Which Is A Better Solution Powerpoint Presentation Free

Ppt Which Is A Better Solution Powerpoint Presentation Free

Insuring A Buy Sell Agreement Tax Treatment Incite Tax

Insuring A Buy Sell Agreement Tax Treatment Incite Tax

Elevate Your Life Life Insurance Policy Tax Exemptions Section

Elevate Your Life Life Insurance Policy Tax Exemptions Section

Pin By Buyonlinelic On Insurance Investment Life Insurance

Pin By Buyonlinelic On Insurance Investment Life Insurance

Medical Expenses Deductions Health Insurance System Ibm Japan

Medical Expenses Deductions Health Insurance System Ibm Japan

Blog The Tunstall Organization Inc The Tunstall Organization

Blog The Tunstall Organization Inc The Tunstall Organization

Post a Comment for "Deduct Life Insurance Premiums"