Declining Term Life Insurance

Surprisingly enough elevated blood pressure levels are usually not a reason to. Decreasing term life insurance sometimes known as mortgage decreasing term insurance is bought by homeowners who want to make sure their mortgage will be settled after their death.

Whole Life Insurance How It Works

Whole Life Insurance How It Works

Lipids cholesterol or triglycerides.

Declining term life insurance. It is the affordable counterpart to whole life insurance which provides permanent coverage for life. Decreasing term insurance is a more affordable option than whole life or universal life insurancethe death benefit is designed to mirror the amortization schedule of a mortgage or other high. At the beginning of the policy the insured will have the largest potential death benefit.

Over time the death benefit amount decreases. To some extent the carrier is reducing its risk with such a declining benefit set up. Some people want a policy to cover their familys anticipated cost of living including mortgage payments and college tuition while others might have less of a need for life insurance down the road.

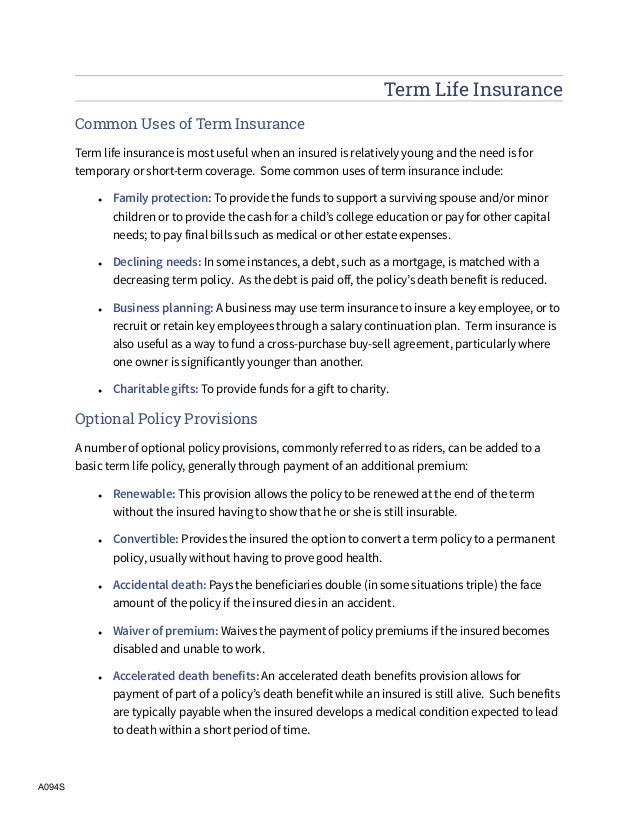

Is a decreasing term life insurance right for you. So often with insurance in general be it life health or others people like to play fortune teller. What is term life insurance.

Top 10 reasons for being declined life insurance 1. With this type of policy you purchase a guaranteed death benefit for a fixed premium. The number of term life insurance quotes taking place is declining due to appealing new products in the life insurance marketplace.

Term life insurance quotes declining. Term life is a type of life insurance that ensures a death benefit money paid to your spouse or heirs to cover income loss and assets in the event of your death with a fixed premium for a set period of time your term. Elevated cholesterol levels can often lead to a denial on life insurance as well as an unpleasant surprise for the applicant.

More and more people are passing up the simplicity of term life insurance products for more complicated hybrid policies that often offer more benefits. Declining term life insurance provides you with a decreasing amount of life insurance coverage each year while your insurance premiums remain the level for the entire term of your policy. Decreasing term life insurance used to be very popular but sales have been dying and only a few companies still offer it anymore.

So whats our take on declining term life insurance. After a few years the face value will decrease. Declining term insurance is a type of life insurance in which the face value of the policy decreases as time goes by.

Every individual has a specific need for life insurance. Indeed many mortgage lenders stipulate that life insurance must be in place at the outset of your agreement. Decreasing term insurance is usually used to provide life insurance protection for your outstanding mortgage also called mortgage payment protection insurance.

Dual Or Joint Life Insurance Which Is Best Lion Ie

Dual Or Joint Life Insurance Which Is Best Lion Ie

Declining Term Life Insurance The Life Insurance Blog

Declining Term Life Insurance The Life Insurance Blog

Back Any Individual Aged 60 Years Or Above Is A Senior Citizen

Back Any Individual Aged 60 Years Or Above Is A Senior Citizen

Term Life Insurance Rates Rise

Term Life Insurance Rates Rise

New York Now On Twitter Defrancisco4ny On Double Dipping On

New York Now On Twitter Defrancisco4ny On Double Dipping On

Mrtas Mltas What Are They And Do I Need It

Mrtas Mltas What Are They And Do I Need It

A Totally Not Boring Guide To Life Insurance Wealthsimple

A Totally Not Boring Guide To Life Insurance Wealthsimple

Faq Ltc Price Northwestern Mutual

Faq Ltc Price Northwestern Mutual

After More Than A Decade Of Decline Term Life Insurance Rates

After More Than A Decade Of Decline Term Life Insurance Rates

Is Whole Life Insurance Right For You Consumer Reports

Is Whole Life Insurance Right For You Consumer Reports

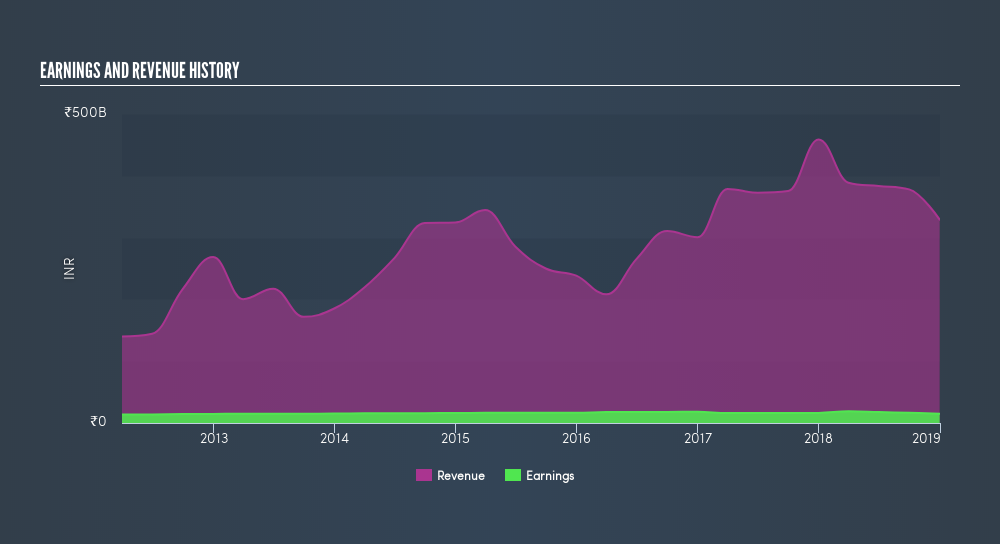

Life Insurance Market Growth Or Decline Potential In Russia 2015

Life Insurance Market Growth Or Decline Potential In Russia 2015

What Is Cash Value Life Insurance Daveramsey Com

What Is Cash Value Life Insurance Daveramsey Com

Whole Life Insurance Cash Value Chart

What Are The Different Types Of Life Insurance Policies Market

What Are The Different Types Of Life Insurance Policies Market

Is Mortgage Life Insurance The Best Deal Out There

Is Mortgage Life Insurance The Best Deal Out There

Term Insurance Tax Saving Don T Buy Term Insurance Just To Save

Term Insurance Tax Saving Don T Buy Term Insurance Just To Save

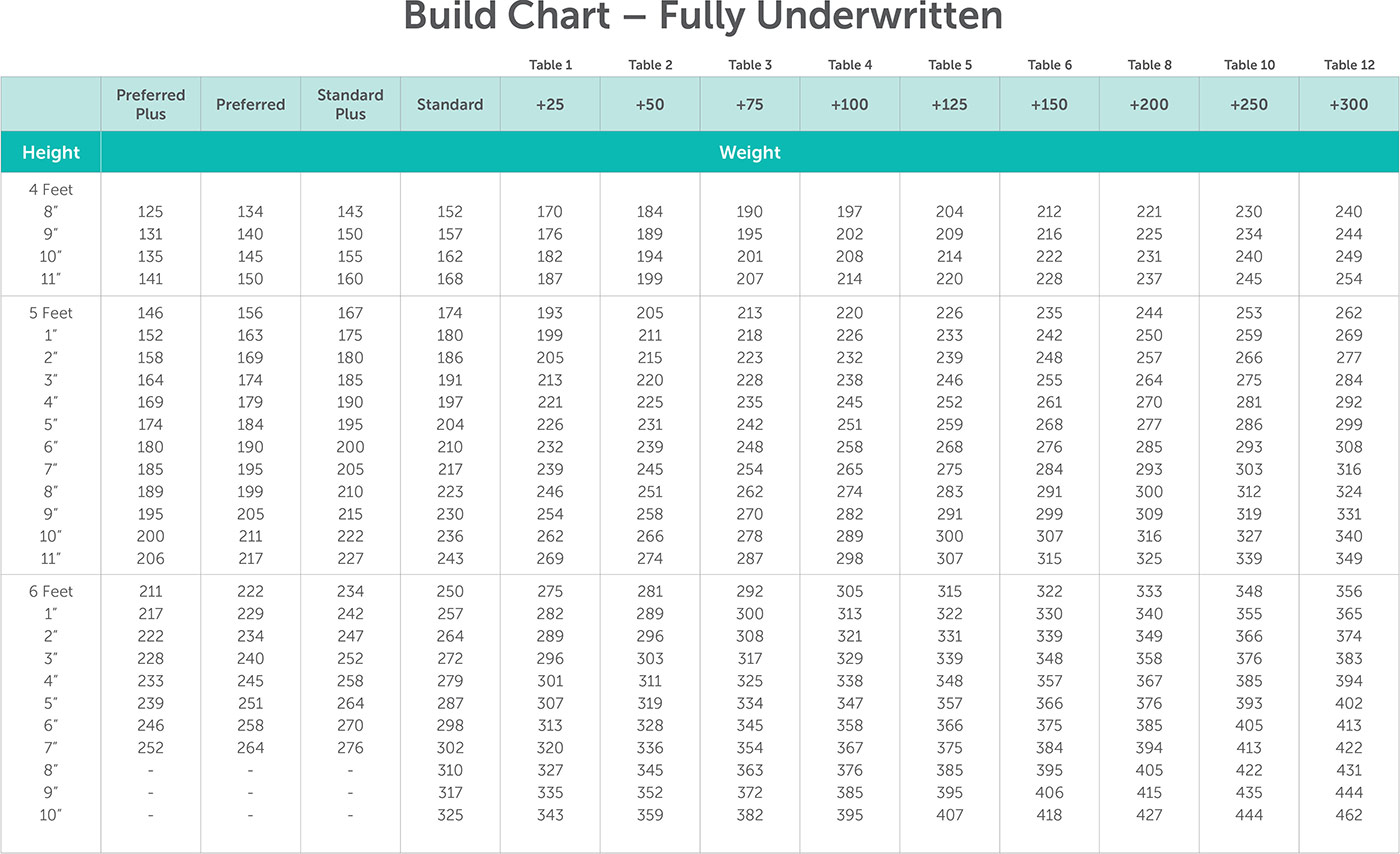

What Are The Risk Factors That Affect Buying Life Insurance Quotacy

What Are The Risk Factors That Affect Buying Life Insurance Quotacy

How Do I Cancel My Life Insurance Policy Cancel Life Insurance

How Do I Cancel My Life Insurance Policy Cancel Life Insurance

:max_bytes(150000):strip_icc()/GettyImages-1083840976-a828869589624ed28316b9352c7aff11.jpg)

Post a Comment for "Declining Term Life Insurance"