Employer Group Life Insurance

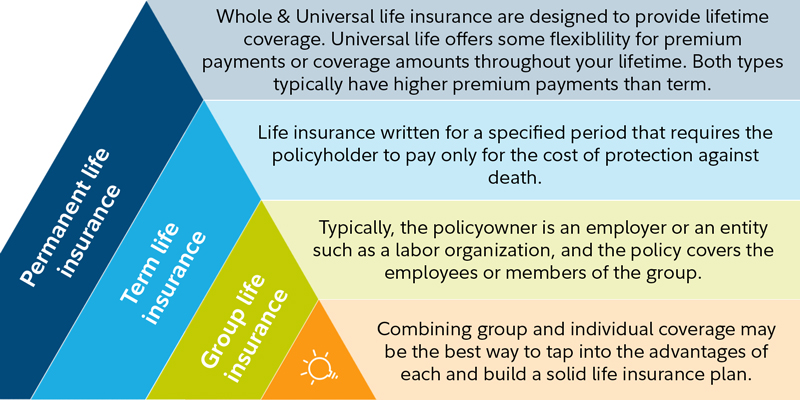

This coverage is excluded as a de minimis fringe benefit. The rates for whole life insurance are often significantly higher than for term life insurance but can be a great value for a person who wants to make sure that no matter what his policy will never expire and his premium will never increase.

Understanding Group Life Insurance Pdf Free Download

Understanding Group Life Insurance Pdf Free Download

Whole life insurance is a life policy that is designed to cover you for your entire lifetime.

Employer group life insurance. Depending on the length of time you have had your life insurance policy you may have built a large amount of savings you can cash out. Group life insurance is offered by an employer or other large scale entity such an association or labor organization to its workers or members. Whether made compulsory or not there are many reasons for an employer to consider a staff group life insurance scheme to be essential.

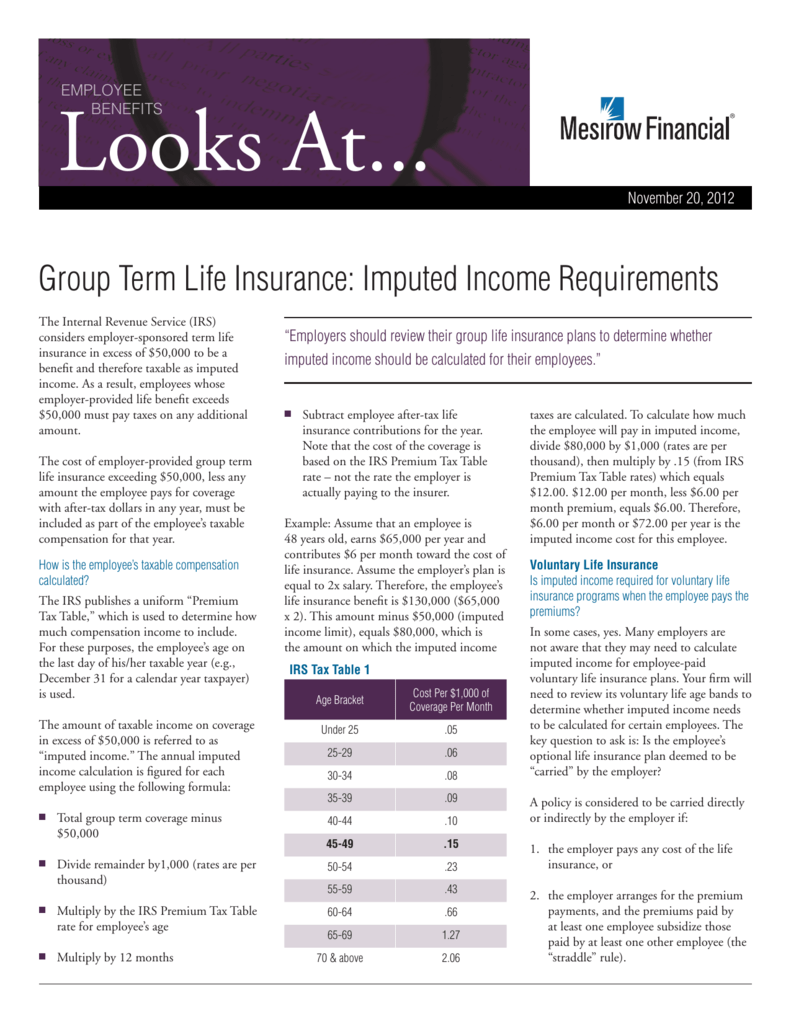

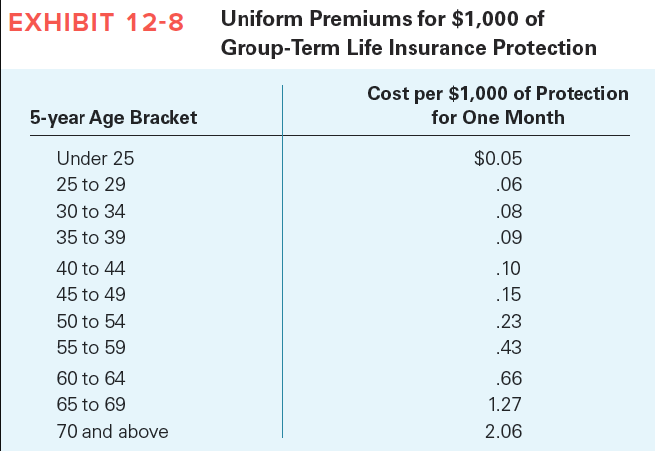

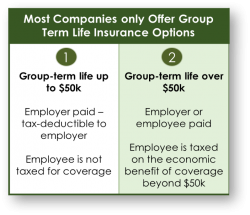

Life other than gul accident critical illness hospital indemnity and disability plans are insured or administered by life insurance company of north america except in ny where insured plans are offered by cigna life insurance company of new york new york ny. The cost of employer provided group term life insurance on the life of an employees spouse or dependent paid by the employer is not taxable to the employee if the face amount of the coverage does not exceed 2000. Group life insurance shows employees you value what matters most to themtheir loved ones.

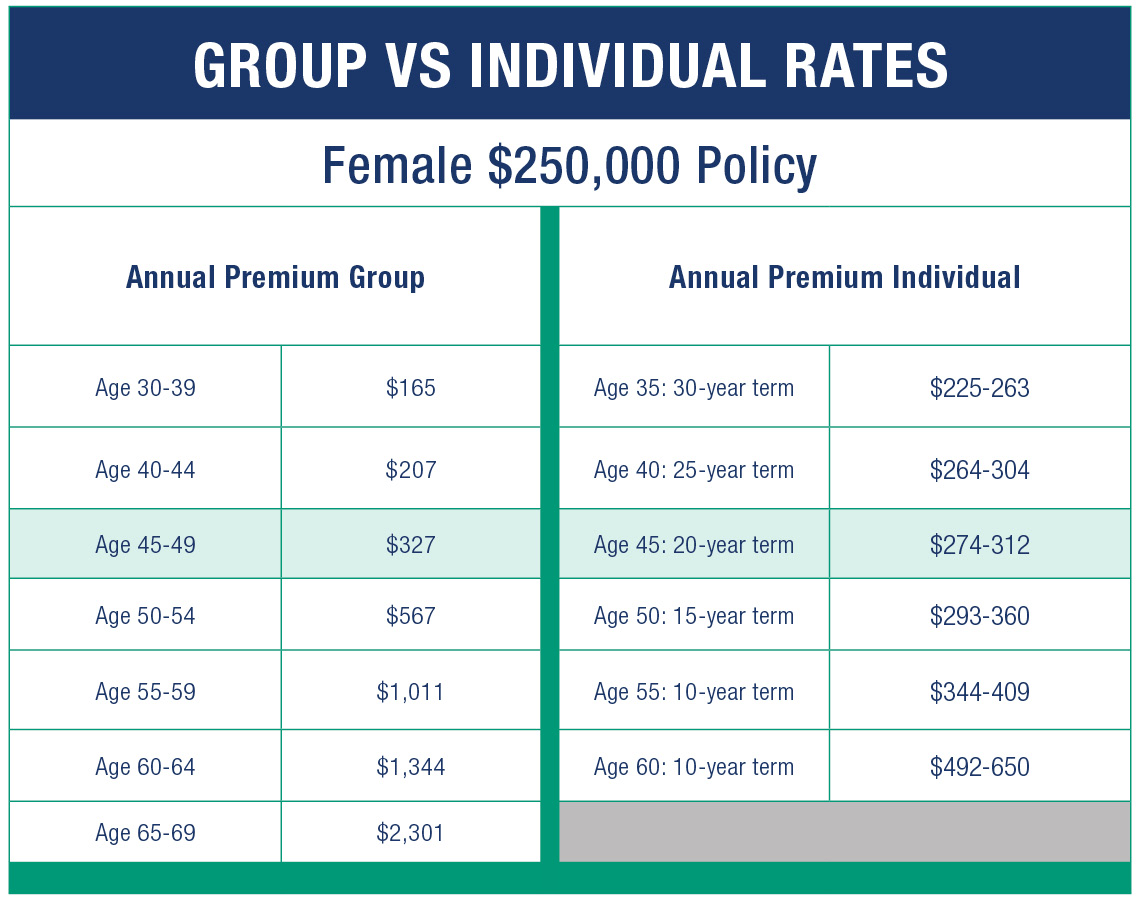

Pros and cons of group life insurance through work. Employer based policies also known as group life insurance are slightly different then individual policies because your employer carries out a group policy either directly or indirectly. Convenience price and acceptance.

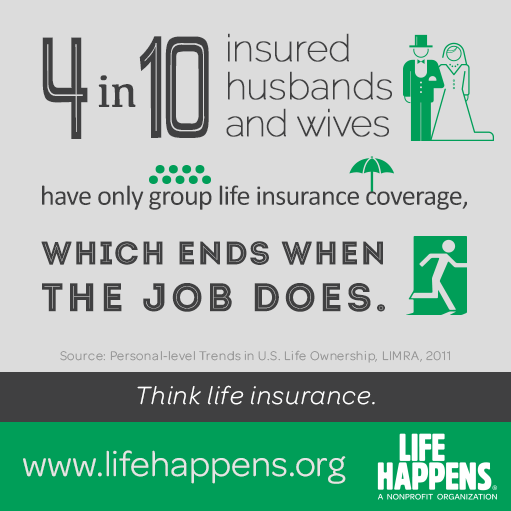

Many employers offering employee benefits consider group term life insurance an essential part of their benefits package. Free life insurance is a great deal but think of group life as a supplement versus a replacement for an individual life insurance policy. There are three main advantages to buying supplemental group life insurance through your employer.

Ten of such reasons are highlighted below. Group life insurance coverage is limited. The employer sponsored group life insurance scheme serves as a very good incentive for recruiting and retaining great staff.

Experts generally advise against relying solely on employer provided group life for protection because you dont control the policy. Group universal life gul insurance plans are insured by cglic.

Hartford Life Insurance Company Hartford Life And Accident

Hartford Life Insurance Company Hartford Life And Accident

Life Insurance Policy Omaha Chastain Otis Insurance

Life Insurance Policy Omaha Chastain Otis Insurance

Group Term Life Insurance Imputed Income

Group Term Life Insurance Imputed Income

Beneficiary Problems With Employer Group Life Insurance

Beneficiary Problems With Employer Group Life Insurance

Group Life Insurance Group Life Insurance Uk

Group Life Insurance Group Life Insurance Uk

Beneficiary Problems With Employer Group Life Insurance

Beneficiary Problems With Employer Group Life Insurance

Employer Provided Group Term Insurance Is Enough Kotak Life

Employer Provided Group Term Insurance Is Enough Kotak Life

Life Insurance Through Employer Cigna

Life Insurance Through Employer Cigna

Solved Grace S Employer Is Now Offering Group Term Life I

Solved Grace S Employer Is Now Offering Group Term Life I

Should You Get Group Life Insurance Through Your Employer Life

Should You Get Group Life Insurance Through Your Employer Life

I Already Have Life Insurance Through My Job Why Do I Need

I Already Have Life Insurance Through My Job Why Do I Need

Online Fringe Benefits Group Term Life Insurance Employer Set Up

Is Your Employer S Group Life Insurance Enough Berry Insurance

Is Your Employer S Group Life Insurance Enough Berry Insurance

Open Enrollment For Employer Paid Life Insurance

Open Enrollment For Employer Paid Life Insurance

Group Life Plans Business Planning Group

Group Life Plans Business Planning Group

Layering Life Insurance Policies Fidelity Investments

Layering Life Insurance Policies Fidelity Investments

Study Shows Lack Of Employer Knowledge About Group Life Assurance

Study Shows Lack Of Employer Knowledge About Group Life Assurance

Understanding Group Life Insurance Pdf Free Download

Understanding Group Life Insurance Pdf Free Download

Employer Paid Tiered Group Life Insurance

Employer Paid Tiered Group Life Insurance

Health And Life Insurance Ppt Video Online Download

Health And Life Insurance Ppt Video Online Download

Group Life Insurance Benesmart

Group Life Insurance Benesmart

Citadel Insurance Group Life Insurance

Is Your Employer Provided Life Insurance Coverage Enough Blog

Is Your Employer Provided Life Insurance Coverage Enough Blog

Post a Comment for "Employer Group Life Insurance"