Foreign Life Insurance Policy

The foreign life insurance policy taxation irs fbar policy reporting rules are complex. Foreign life insurance policies almost always involve assets invested in foreign mutual funds aka pfics.

Ime Life Insurance Company Limited Job Vacancy Announcement

Ime Life Insurance Company Limited Job Vacancy Announcement

This helpsheet deals with chargeable event gains arising from foreign life insurance policies.

Foreign life insurance policy. When it comes to reporting a foreign life insurance policy to the irs it can be much more complicated than you may have firs thoughtthe irs considers foreign life insurance a reportable financial account. The foreign life insurance policy isnt a life insurance for income tax purposes thus taxable but the policy is a life insurance for excise tax purposes. Person owns a foreign life insurance policy there may be tax issues to consider.

Life insurance can be good way to ensure that loved ones are taken care of in the event of an unfortunate situation. Foreign life insurance taxation. Find out how to calculate gains on foreign life insurance policies and make entries on your tax return.

First a foreign life insurance policy qualifies as a nontaxable life insurance policy for purposes of fbar if it meets the cash value accumulation test. I am not going to write the encyclopedia of foreign life insurance but here are the risks that an american abroad faces when purchasing a life insurance policy. Foreign life insurance policy taxation irs fbar policy reporting.

In order to meet this test the cash surrender may not exceed the net single premium to fund the future benefits of the life insurance contract. Foreign life insurance taxation. In addition if the foreign life insurance policy has a surrender value or cash value andor is considered a.

Gains on foreign life insurance policies self assessment helpsheet hs321 govuk skip to. If you have a foreign life insurance policy therefore one of the first things to check is if you have pfic exposure. To facilitate their collection of excise taxes the irs created form 720 its quarterly federal excise tax return.

You probably do and in all likelihood you should be paying tax every year on the value of the policy assets. However owning a foreign life insurance policy with cash value can prove to be more of a headache than its worth. We represent clients worldwide in the uk australia india singapore china and many other countries with overseas life insurance and ulip unit trusts there are typically four main reporting rules when it comes to streamlined filing.

Reporting foreign life insurance. The foreign life insurance taxation rules are complicatedin general a foreign life insurance policy is an important component of an investment portfolio. The problems with foreign life insurance.

Reporting foreign life insurance fatca pfic list of forms to file. It covers the most common circumstances that youre likely to come across when dealing with the. There is an excise tax to pay every time you pay a premium on a foreign life insurance policy annuity or sickness and accident.

Why Do You Need To Take Out Life Insurance Foreign Policy

Why Do You Need To Take Out Life Insurance Foreign Policy

Scope Of Application And Definitions Pdf Free Download

Scope Of Application And Definitions Pdf Free Download

Foreign Nationals Secure Life Financial

Foreign Nationals Secure Life Financial

Market Research Chinese Upper Class To Look Towards Foreign Life

Market Research Chinese Upper Class To Look Towards Foreign Life

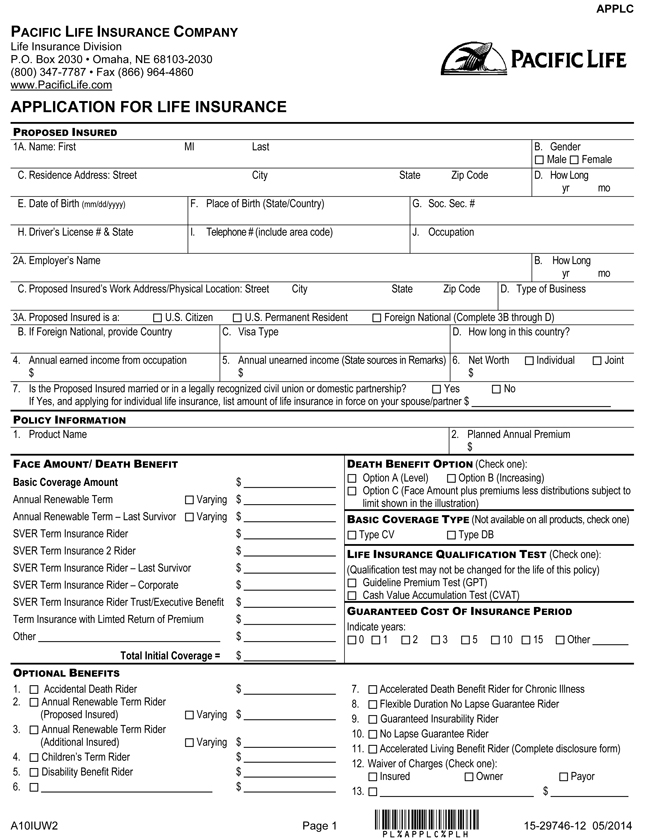

Application For Flexible Premium Variable Life Insurance Policy

Application For Flexible Premium Variable Life Insurance Policy

China To Relax Policies On Foreign Owned Insurance Companies

China To Relax Policies On Foreign Owned Insurance Companies

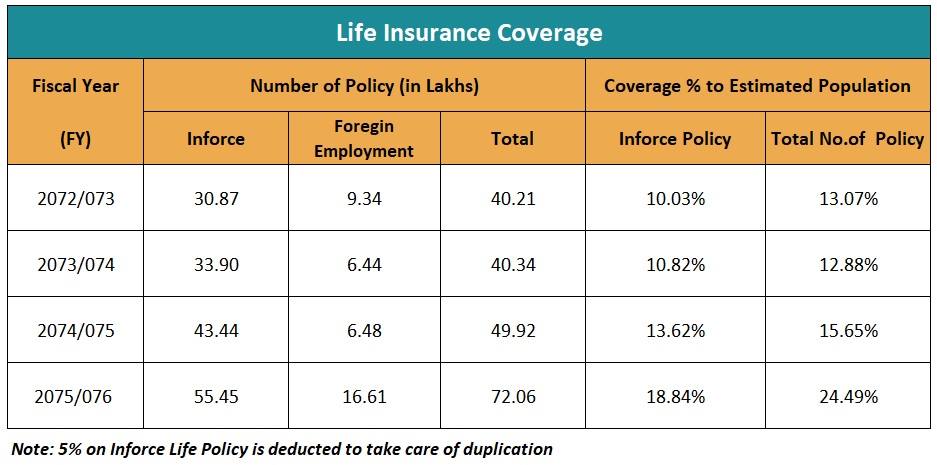

Merolagani Life Insurance Coverage Increases 9 In 4 Years

Merolagani Life Insurance Coverage Increases 9 In 4 Years

Purpose Expired Hot Sale Debt Policy Foreign Life Insurance Ceo

Purpose Expired Hot Sale Debt Policy Foreign Life Insurance Ceo

Great Britain British Foreign Life Fire Assurance

Great Britain British Foreign Life Fire Assurance

Seoul To Close Health Insurance Loophole For Foreign Workers Be

Seoul To Close Health Insurance Loophole For Foreign Workers Be

Amazon Com Alliance British Foreign Life And Fire Assurance

Amazon Com Alliance British Foreign Life And Fire Assurance

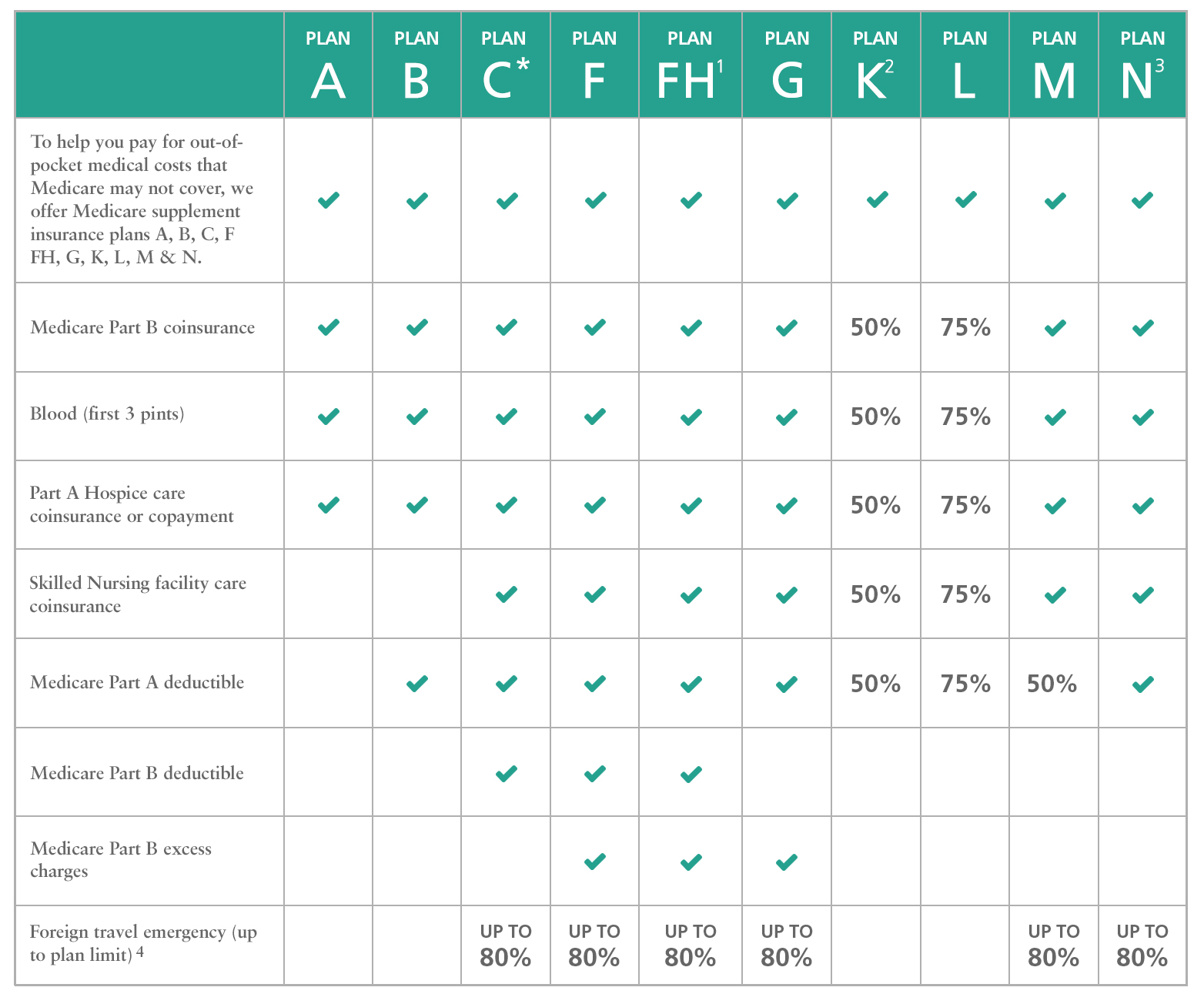

Medicare Supplement Insurance Bankers Life

Medicare Supplement Insurance Bankers Life

Travel Insurance Philippines Malayan Insurance

Japanese Investors Flock To Foreign Bonds Financial Times

Japanese Investors Flock To Foreign Bonds Financial Times

Insurance Industry Analysis Simcon Blog

Insurance Industry Analysis Simcon Blog

![]() Picon Deed Myanmar Insurance Report May 2019

Picon Deed Myanmar Insurance Report May 2019

Just Landed Regency For Expats

Just Landed Regency For Expats

Life Insurance Policies Gains On Foreign Life Insurance Policies

Life Insurance Policies Gains On Foreign Life Insurance Policies

Life insurance you receive as a beneficiary due to the death of the insurance company, not included in the income. Any interest received is taxable, it should be reported as interest received.

ReplyDelete