Fixed Term Life Insurance

This means if you get a 10 year term life insurance policy your rate would stay locked in for 10 years from the date of approval. Term life insurance is a defined policy that guarantees a benefit payout if the covered person dies during the policy term.

Why Buy Level Term Life Insurance

Why Buy Level Term Life Insurance

The policys purpose is to give insurance to.

Fixed term life insurance. We are committed to recommending the best products for our readers. There is no savings component as found in a whole life insurance product. You have a growing family and the financial obligations that come with it.

An alternative to level term life insurance that is particularly appropriate for those with repayment mortgages is decreasing term life insurance. We may receive compensation when you click on links to products but this never affects our reviews or recommendations. Term life policies have no value other than the guaranteed death benefit.

Fixed term life insurance if you are looking for a quick insurance quote then our free online service will meet your needs. Term life insurance or term assurance is life insurance that provides coverage at a fixed rate of payments for a limited period of time the relevant term. Fixed term life insurance offers a death benefit to your beneficiaries if you die within a certain period.

Lets say you have a house with a 30 year mortgage a 48 month auto loan and a college fund youll start using in 10 years. Read about the pros and cons of fixed coverage from five years to 30 year term life insurance in this post. This is a good type of coverage to get while your kids are growing up or.

Fixed life is another label for whole life which combines life insurance and savings into one account. After that period expires coverage at the previous rate of premiums is no longer guaranteed and the client must either forgo coverage or potentially obtain further coverage with different payments or conditions. Its easy and fast.

As the name would suggest with these kinds of policies the pay out decreases over time as the size of outstanding repayments on your mortgage or other debts go down. Level term life. Decreasing term life insurance.

Level term life insurance is a term life insurance policy that keeps your rates fixed for the duration of the term period. Best term life insurance policies of 2020 flexible policy options to fit your budget.

Non Medical Life Insurance Purchasing Life Insurance Without An Exam

Non Medical Life Insurance Purchasing Life Insurance Without An Exam

Life Insurance Over 70 How To Find The Right Coverage

Life Insurance Over 70 How To Find The Right Coverage

Term Life Vs Whole Life Insurance Daveramsey Com

Term Life Vs Whole Life Insurance Daveramsey Com

Low Cost Term Life Insurance The Most Used Inexpensive Policies

Low Cost Term Life Insurance The Most Used Inexpensive Policies

Latest Hd Fixed Term Life Insurance Quotes Thenestofbooksreview

Latest Hd Fixed Term Life Insurance Quotes Thenestofbooksreview

The Differences Between Term And Whole Life Insurance

The Differences Between Term And Whole Life Insurance

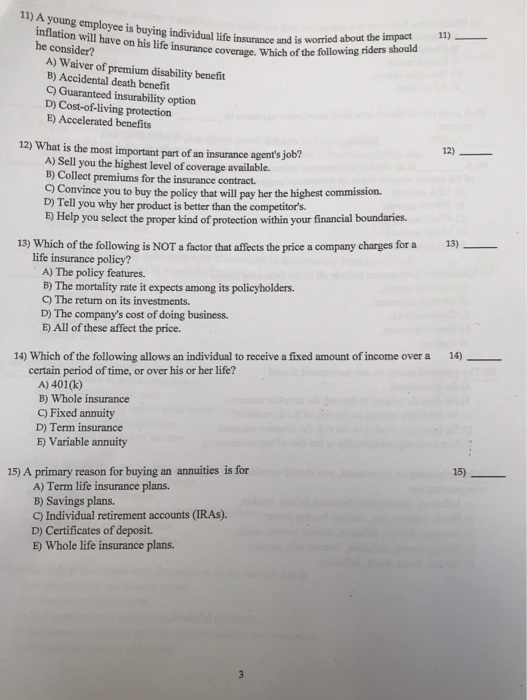

Solved 11 Vidual Life Insurance And Is Worried About The

Solved 11 Vidual Life Insurance And Is Worried About The

Term Life Insurance Limits Banding Renewal And Benefits

Term Life Insurance Limits Banding Renewal And Benefits

What Is Term Life Insurance Cheap Life Insurance For Young People

Divorce And The Benefits Of Life Insurance Divorce Dimensions Inc

Divorce And The Benefits Of Life Insurance Divorce Dimensions Inc

Term Life Vs Whole Life Insurance Which Type Of Life Insurance

Term Life Vs Whole Life Insurance Which Type Of Life Insurance

Top Universal Whole Life Insurance Quotes Best Life Quotes In Hd

Top Universal Whole Life Insurance Quotes Best Life Quotes In Hd

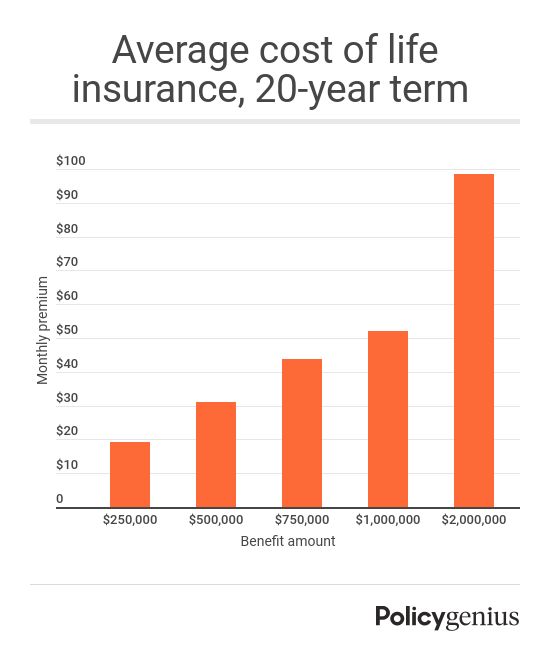

The Cost Of Life Insurance Policygenius

The Cost Of Life Insurance Policygenius

Fixed Term Life Insurance Instant Quotes Top Rated Carriers

Fixed Term Life Insurance Instant Quotes Top Rated Carriers

Ada Term Life Vs Ada Level Term Life Insurance

Ada Term Life Vs Ada Level Term Life Insurance

Aa Life Insurance 2020 Review Reassured

Aa Life Insurance 2020 Review Reassured

What S The Cost Of Term Life Insurance 2020 Monthly Rates

What S The Cost Of Term Life Insurance 2020 Monthly Rates

10 15 20 25 30 35 Year Term Life Insurance Lengths Which Is Best

10 15 20 25 30 35 Year Term Life Insurance Lengths Which Is Best

Level Term Vs Decreasing Term Life Insurance Direct Line

Level Term Vs Decreasing Term Life Insurance Direct Line

Search Q Term Vs Whole Life Tbm Isch

Life Insurance Online Discover Best Life Cover Plans Policy In

Life Insurance Online Discover Best Life Cover Plans Policy In

Fixed Term Life Insurance Explained Text Background Word Cloud

Fixed Term Life Insurance Explained Text Background Word Cloud

Post a Comment for "Fixed Term Life Insurance"